Popular on EntSun

- Crossroads4Hope Welcomes New Trustees to Board of Directors as Organization Enters 25th Year of Caring - 202

- New Medium Article Explores Why Emotional Conversations Fail and What Most People Don't Understand About Connection - 147

- Still Using Ice? FrostSkin Reinvents Hydration - 143

- $80 Million Revenue Backlog for AI Cybersecurity Company Building the Future of Integrated Cybersecurity and Public Safety: $CYCU - 140

- Does EMDR Really Work? New Article Explores How Trauma Gets Stuck in the Brain and How Healing Begins - 138

- Postmortem Pathology Expands to Phoenix: Bringing Families Answers During Their Most Difficult Moments - 135

- From "Law & Order" to the Lens: Matthew Bennett Photography Redefines the Professional Portrait in Downtown Toronto - 125

- HBMHCW Expande Infraestructura de Cumplimiento para Argentina mientras América Latina Supera $1.5 Billones en Volumen Cripto - 119

- CLIKA Built Authenticity at Studio Scale Through a Cultural Lens — Casting Director Paul Sinacore - 112

- A 40-Year Secret Finally Finds Its Voice: Aketous Releases Retro-Pop Anthem "Touch My Soul" - 112

Similar on EntSun

- Delay In Federal Disaster Assistance Causing Failure Of Small Business In Disaster Areas

- When Representation No Longer Reflects the District — Why I'm Voting for Pete Verbica

- Off The Hook YS (NY SE: OTH) Executes Transformational Apex Acquisition, Creating Vertically Integrated Marine Powerhouse with $60M Inventory Capacity

- Tri-State Area Entrepreneur Launches K-Chris: A Premium Digital Destination for Luxury Fragrances

- Why One American Manufacturer Builds BBQ Smokers to Aerospace Standards

- Diversified Roofing Solutions Strengthens Industry Leadership With Expanded Roofing Services Across South Florida

- $36 Million LOI to Acquire High Value Assets from Vivakor Inc in Oklahoma's STACK Play — Building Cash Flow and Scalable Power Infrastructure; $OLOX

- Kobie Wins for AI Innovations in the 2026 Stevie® Awards for Sales & Customer Service

- Art of Whiskey Hosts 3rd Annual San Francisco Tasting Experience During Super Bowl Week

- FDA Meeting Indicates a pivotal development that could redefine the treatment landscape for suicidal depression via NRx Pharmaceuticals: $NRXP

Record Revenues, Debt-Free Momentum & Shareholder Dividend Ignite Investor Attention Ahead of 2026–2027 Growth Targets: IQSTEL (N A S D A Q: IQST)

EntSun News/11078916

IQSTEL, Inc. (N A S D A Q: IQST) $IQST Reports Record Q3 2025 Results with $102.8 Million Quarterly Revenue, 42% Sequential Growth and Strengthened Balance Sheet.

CORAL GABLES, Fla. - EntSun -- In a year marked by breakneck expansion across telecommunications, fintech, AI, and next-generation cybersecurity, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as one of Nasdaq's most compelling growth stories. With record-setting financial results, a rapidly strengthening balance sheet, major acquisitions already bearing fruit, and the confirmation of a $500,000 dividend payable in free-trading shares, IQSTEL is signaling to the market that its long-term value creation strategy is taking hold—fast.

Investors watching for the next transformative mid-cap technology contender may now be seeing its early inflection point.

A $500,000 Shareholder Dividend—A Rare Move Among Emerging Tech Firms

On December 3rd, IQSTEL confirmed it will distribute a $500,000 dividend in free-trading IQST common shares. The dividend, calculated at the August 29, 2025 closing price of $6.62, equates to 75,529 shares to be distributed to shareholders of record as of December 15th, with payment on December 30th.

With just 4.37 million shares outstanding, the distribution ratio of 0.0173 per share reflects a meaningful capital return—especially for a debt-free emerging tech company on Nasdaq.

CEO Leandro Iglesias emphasized that this marks the beginning of annual dividends tied directly to performance, stating:

"IQSTEL has fulfilled every promise we made to our shareholders… This $500,000 dividend is a testament to our vision, our execution, and our unwavering dedication to rewarding those who believe in our mission."

In the current market cycle, where investor trust is hard-won, this move could set IQSTEL apart from many of its growth-stage peers.

Record Q3 2025 Results: 42% Sequential Revenue Growth

IQSTEL's financial performance is heating up—rapidly.

More on EntSun News

Q3 2025 Revenue: $102.8 million

Up 42% from Q2 and nearly double year-over-year.

The company now reports:

These numbers underscore one of the strongest balance sheets among emerging tech corporations on Nasdaq—particularly for one with global operating reach across 21 countries.

A Debt-Free Nasdaq Company with a Clean Capital Structure

In October, IQSTEL made a strategic leap rarely seen at its stage:

The company eliminated every remaining convertible note and now carries no warrants and no convertible debt.

This resets the company's capitalization to a "clean slate" just as it enters a period of accelerating multi-division growth. For institutional investors wary of dilution risk in small-cap tech, this could be a turning point.

Fintech Expansion Accelerates EBITDA Growth: Globetopper Already Performing

Following its July 1st acquisition of Globetopper, IQSTEL has begun harnessing its powerful international telecom business platform—reaching 600+ global operators—to rapidly scale fintech services.

In Q3 2025 alone:

This division is now a key pillar in IQSTEL's plan to achieve a $15 million EBITDA run rate by 2026.

AI & Cybersecurity: First Phase of Next-Gen Cyber Defense Rolled Out

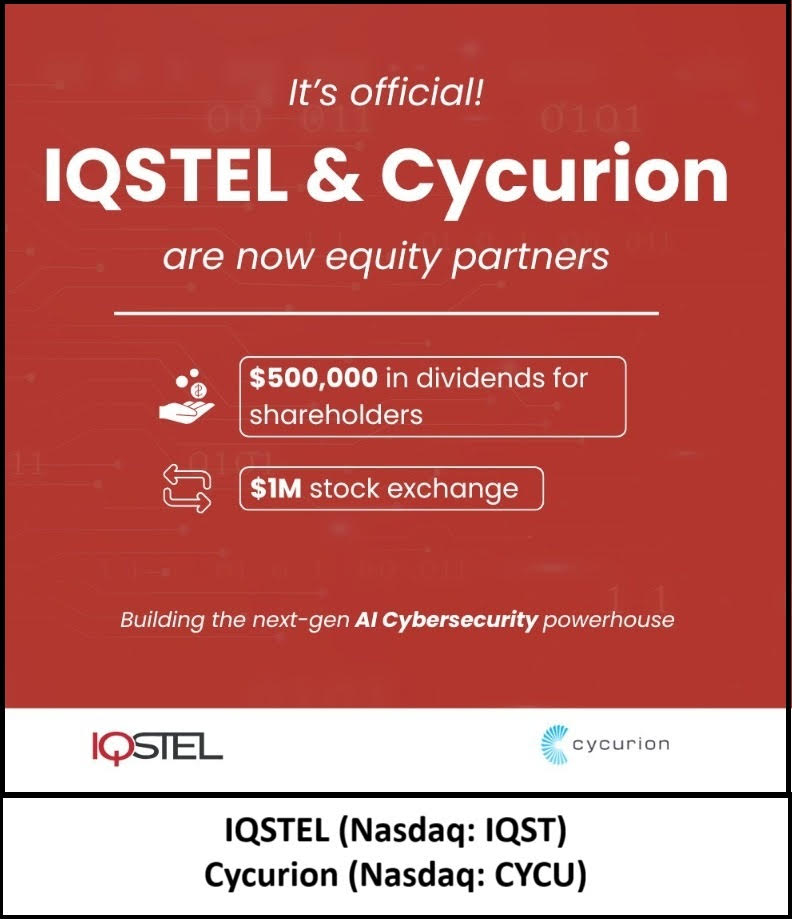

IQSTEL's AI subsidiary, Reality Border, has completed Phase One of its partnership with Cycurion (N A S D A Q: CYCU)—a U.S. government-certified cybersecurity provider.

Together they are deploying a new breed of AI agents fortified by ARx multi-layer cyber defense, including:

This positions IQSTEL at the nexus of AI-driven telecom solutions and next-generation cyber protection—two sectors increasingly converging.

More on EntSun News

Launch of IQ2Call: A Play for a Share of the $750 Billion Global Telecom Market

IQSTEL has rolled out IQ2Call, a vertically integrated AI-powered telecom system that blends:

This expansion positions the company to compete across an addressable market exceeding $750 billion globally.

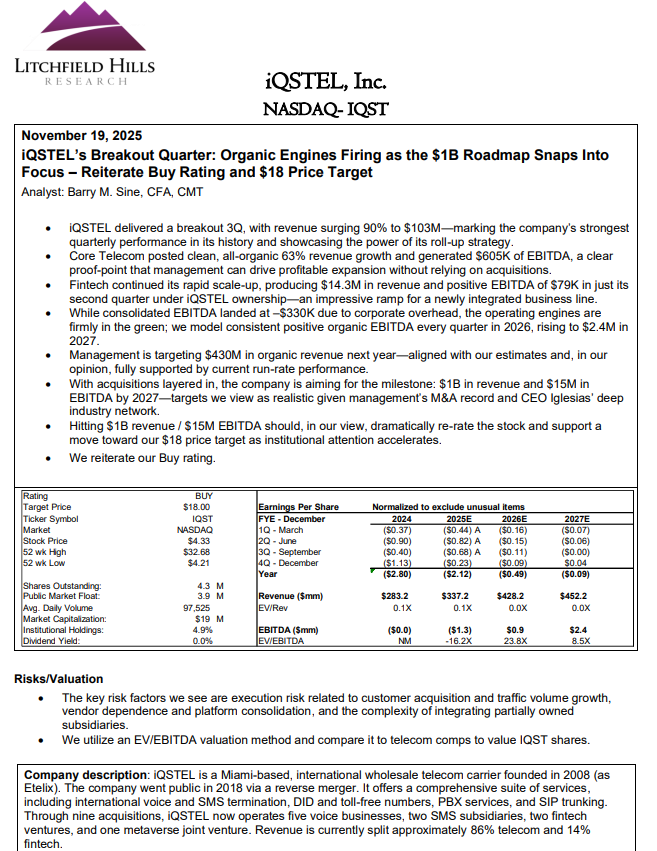

Analyst Coverage: $18 Price Target from Litchfield Hills Research

Litchfield Hills Research recently issued coverage on IQSTEL with a Buy rating and an $18 price target, reflecting confidence in the company's multi-division synergy, strong balance sheet, and aggressive—but measurable—growth milestones.

A Clear Roadmap to $1 Billion Revenue by 2027

IQSTEL projects $340 million in revenue for FY-2025 and sees its path to $1 billion by 2027 supported by:

Given its recent quarterly acceleration, the company's targets—once ambitious—now appear increasingly attainable.

Why Investors Are Paying Close Attention

IQSTEL is entering 2026 with a powerful combination rarely seen among emerging tech companies:

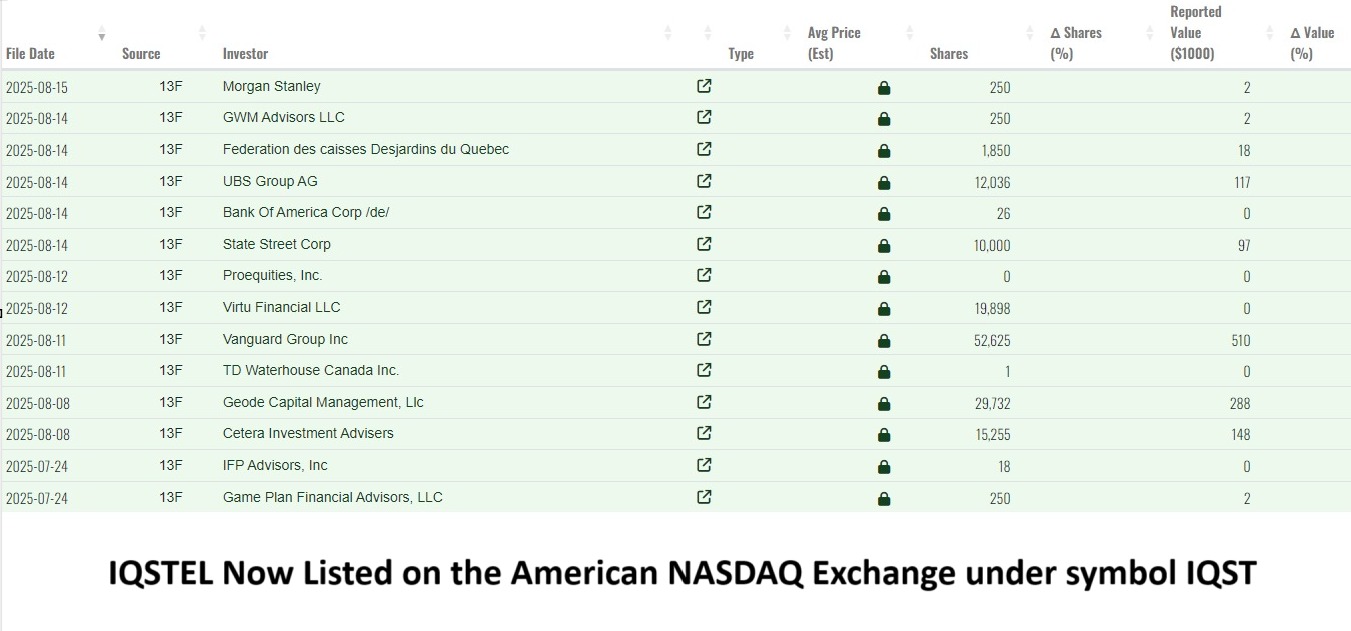

For investors seeking exposure to a diversified, global digital communications and AI company with disciplined capital management and aggressive growth targets, IQSTEL is becoming difficult to ignore.

Investor Resources

Media Contact:

IQSTEL, Inc.

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Investors watching for the next transformative mid-cap technology contender may now be seeing its early inflection point.

A $500,000 Shareholder Dividend—A Rare Move Among Emerging Tech Firms

On December 3rd, IQSTEL confirmed it will distribute a $500,000 dividend in free-trading IQST common shares. The dividend, calculated at the August 29, 2025 closing price of $6.62, equates to 75,529 shares to be distributed to shareholders of record as of December 15th, with payment on December 30th.

With just 4.37 million shares outstanding, the distribution ratio of 0.0173 per share reflects a meaningful capital return—especially for a debt-free emerging tech company on Nasdaq.

CEO Leandro Iglesias emphasized that this marks the beginning of annual dividends tied directly to performance, stating:

"IQSTEL has fulfilled every promise we made to our shareholders… This $500,000 dividend is a testament to our vision, our execution, and our unwavering dedication to rewarding those who believe in our mission."

In the current market cycle, where investor trust is hard-won, this move could set IQSTEL apart from many of its growth-stage peers.

Record Q3 2025 Results: 42% Sequential Revenue Growth

IQSTEL's financial performance is heating up—rapidly.

More on EntSun News

- Off The Hook YS (NY SE: OTH) Executes Transformational Apex Acquisition, Creating Vertically Integrated Marine Powerhouse with $60M Inventory Capacity

- Tri-State Area Entrepreneur Launches K-Chris: A Premium Digital Destination for Luxury Fragrances

- Why One American Manufacturer Builds BBQ Smokers to Aerospace Standards

- Diversified Roofing Solutions Strengthens Industry Leadership With Expanded Roofing Services Across South Florida

- ZRCalc™ Cinema Card Calculator Now Available for Nikon ZR Shooters

Q3 2025 Revenue: $102.8 million

Up 42% from Q2 and nearly double year-over-year.

The company now reports:

- $232.6 million in revenue through the first nine months of 2025

- $411.5 million revenue run rate

- Adjusted EBITDA of $683,189 in Q3

- Assets of $46.8 million ($12.23 per share)

- Stockholders' equity of $17.8 million ($4.66 per share)—a 50% increase from FY-2024

These numbers underscore one of the strongest balance sheets among emerging tech corporations on Nasdaq—particularly for one with global operating reach across 21 countries.

A Debt-Free Nasdaq Company with a Clean Capital Structure

In October, IQSTEL made a strategic leap rarely seen at its stage:

The company eliminated every remaining convertible note and now carries no warrants and no convertible debt.

This resets the company's capitalization to a "clean slate" just as it enters a period of accelerating multi-division growth. For institutional investors wary of dilution risk in small-cap tech, this could be a turning point.

Fintech Expansion Accelerates EBITDA Growth: Globetopper Already Performing

Following its July 1st acquisition of Globetopper, IQSTEL has begun harnessing its powerful international telecom business platform—reaching 600+ global operators—to rapidly scale fintech services.

In Q3 2025 alone:

- Globetopper contributed ~$16 million in revenue

- And delivered $110,000 in EBITDA, making it cash flow positive

This division is now a key pillar in IQSTEL's plan to achieve a $15 million EBITDA run rate by 2026.

AI & Cybersecurity: First Phase of Next-Gen Cyber Defense Rolled Out

IQSTEL's AI subsidiary, Reality Border, has completed Phase One of its partnership with Cycurion (N A S D A Q: CYCU)—a U.S. government-certified cybersecurity provider.

Together they are deploying a new breed of AI agents fortified by ARx multi-layer cyber defense, including:

- Airweb.ai (Web AI agent)

- IQ2Call.ai (Voice AI agent)

- Built on a secure Model Context Protocol (MCP)

This positions IQSTEL at the nexus of AI-driven telecom solutions and next-generation cyber protection—two sectors increasingly converging.

More on EntSun News

- WeCarryBags: Building a Global Retail Ecosystem and Attracting Investment

- The Mayhem Method: Devon Wallace Builds a 6-Figure Entertainment and AI Empire

- iPOP Alum Ethan Cole Cast in Peacock Series "The Burbs"

- Revolutionary Data Solution Transforms Health Insurance Underwriting Accuracy

- $36 Million LOI to Acquire High Value Assets from Vivakor Inc in Oklahoma's STACK Play — Building Cash Flow and Scalable Power Infrastructure; $OLOX

Launch of IQ2Call: A Play for a Share of the $750 Billion Global Telecom Market

IQSTEL has rolled out IQ2Call, a vertically integrated AI-powered telecom system that blends:

- Real-time communications

- AI agents

- Data analytics

- Cybersecurity infrastructure

This expansion positions the company to compete across an addressable market exceeding $750 billion globally.

Analyst Coverage: $18 Price Target from Litchfield Hills Research

Litchfield Hills Research recently issued coverage on IQSTEL with a Buy rating and an $18 price target, reflecting confidence in the company's multi-division synergy, strong balance sheet, and aggressive—but measurable—growth milestones.

A Clear Roadmap to $1 Billion Revenue by 2027

IQSTEL projects $340 million in revenue for FY-2025 and sees its path to $1 billion by 2027 supported by:

- Organic growth across telecom and fintech

- Strategic acquisitions

- Accelerated roll-out of advanced AI and cybersecurity products

- High-margin product expansion using its existing global customer trust

Given its recent quarterly acceleration, the company's targets—once ambitious—now appear increasingly attainable.

Why Investors Are Paying Close Attention

IQSTEL is entering 2026 with a powerful combination rarely seen among emerging tech companies:

- Record revenue momentum

- Strong EBITDA progression

- Zero debt, zero convertibles, zero warrants

- Annual dividend initiation

- Rapid AI and cybersecurity expansion

- New fintech profitability

- One of the strongest balance sheets in its peer group

For investors seeking exposure to a diversified, global digital communications and AI company with disciplined capital management and aggressive growth targets, IQSTEL is becoming difficult to ignore.

Investor Resources

Media Contact:

IQSTEL, Inc.

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business, Technology

0 Comments

Latest on EntSun News

- CCHR: Decades of Warnings, Persistent Inaction; Studies Raise New Alarms on Psychiatric Drug Safety

- PRÝNCESS Builds Anticipation With "My Nerves" — A Girls-Girl Anthem

- Arbutus Medical Raises C$9.3M to Accelerate Growth of Surgical Workflow Solutions Outside the OR

- From Sleepless Nights to Sold-Out Drops: Catch Phrase Poet's First Year Redefining Motivational Urban Apparel

- Cold. Clean. Anywhere. Meet FrostSkin

- How Specialized Game Development Services Are Powering the Next Wave of Interactive Entertainment

- Don't Settle for a Lawyer Who Just Speaks Spanish. Demand One Who Understands Your Story

- Dan Williams Promoted to Century Fasteners Corp. – General Manager, Operations

- Ski Johnson Inks Strategic Deals with Three Major Food Chain Brands

- NIL Club Advances Agent-Free NIL Model as Oversight Intensifies Across College Athletics

- Atlanta Magazine Names Dr. Rashad Richey One of Atlanta's Most Influential Leaders in 2026 as the FIFA World Cup Approaches

- Apostle Margelee Hylton Announces the Release of Third Day Prayer

- Author, Philanthropist Ethel Gardner Joins Creators' Rights Movement Advisory Board

- Slotozilla Reports Strong Q4 Growth and Sigma Rome Success

- "Lights Off" and Laughs On: Joseph Neibich Twists Horror Tropes in Hilariously Demonic Fashion

- From Stand-Up to Seductive Demons: A Conversation with Joseph Neibich on Lights Off

- Families Gain Clarity: Postmortem Pathology Expands Private Autopsy Services in St. Louis

- CASTING CALL For Major Television Series

- Beethoven: Music of Revolution and Triumph - Eroica

- Songwriter Jay Ryan Smith releases "Certified Texan"