Popular on EntSun

- UK Financial Ltd Board of Directors Establishes Official News Distribution Framework and Issues Governance Decision on Official Telegram Channels - 261

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026 - 217

- Justin Jeansonne An Emerging Country Singer-Songwriter Music Fans Have Been Waiting For…a True Maverick - 164

- "I Make Music Not Excuses" Journal by Anthony Clint Jr. Becomes International Amazon Best Seller, Empowering Music Creators Worldwide - 155

- Crunchbase Ranks Phinge Founder & CEO Robert DeMaio #1 Globally. Meet him in Las Vegas-Week of CES to Learn About Netverse, Patented App-less Platform - 152

- "Micro-Studio": Why San Diegans are Swapping Crowded Gyms for Private, One-on-One Training at Sweat Society - 141

- VDG Virtuoso Emerges as a New-Model Independent Industry Figure Blending Artist, Executive, and Infrastructure Builder - 130

- Phillip E. Walker's Hollywood Actor Jobs Dec. 10-20, 2025 PRE-TOUR Launches with SweetestVacation.com at CulverCityFilmFestival.com & Closes in the IE - 124

- Donna Cardellino Manager/Facilitator Signs Justin Jeansonne Country Singer-Songwriter To Exclusive Management Deal For Global Music Expansion - 119

- Contracting Resources Group Receives 2025 HIRE Vets Platinum Medallion Award from the U.S. Department of Labor - 115

Similar on EntSun

- How Democrats Made Healthcare More Expensive in 2026

- Inkdnylon Launches Bilingual Ask Inkdnylon Platform

- FrostSkin Launches Kickstarter Campaign for Patent-Pending Instant-Chill Water Purification Bottle

- The New Monaco of the South (of Italy)

- Walmart $WMT and COSTCO.COM $COST Distribution as SonicShieldX™ Platform Sets the Stage for Accelerated Growth in 2026: AXIL Brands (N Y S E: AXIL)

- AI-Driven Drug Development with Publication of New Bioinformatics Whitepaper for BullFrog AI: $BFRG Strengthens Its Position in AI Drug Development

- IQSTEL Enters 2026 from a Position of Strength Following Transformational Year Marked by N A S D A Q Uplisting, Record Revenue and First-Ever

- Appliance EMT Expands Professional Appliance Repair Services to Hartford, Connecticut

- OneSolution® Expands to Orlando with New Altamonte Springs Implant Center

- Robert DeMaio, Phinge Founder & CEO, Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

$56.7 Million Announced in Q1 2025 with Revenue Growth and Progress Toward NASDAQ Uplisting for AI Marketing Company: IQSTEL, Inc. Stock Symbol: IQSTD

EntSun News/11058293

IQSTEL, Inc. (Stock Symbol: IQSTD) On Track Towards $1 Billion in Revenue by 2027.

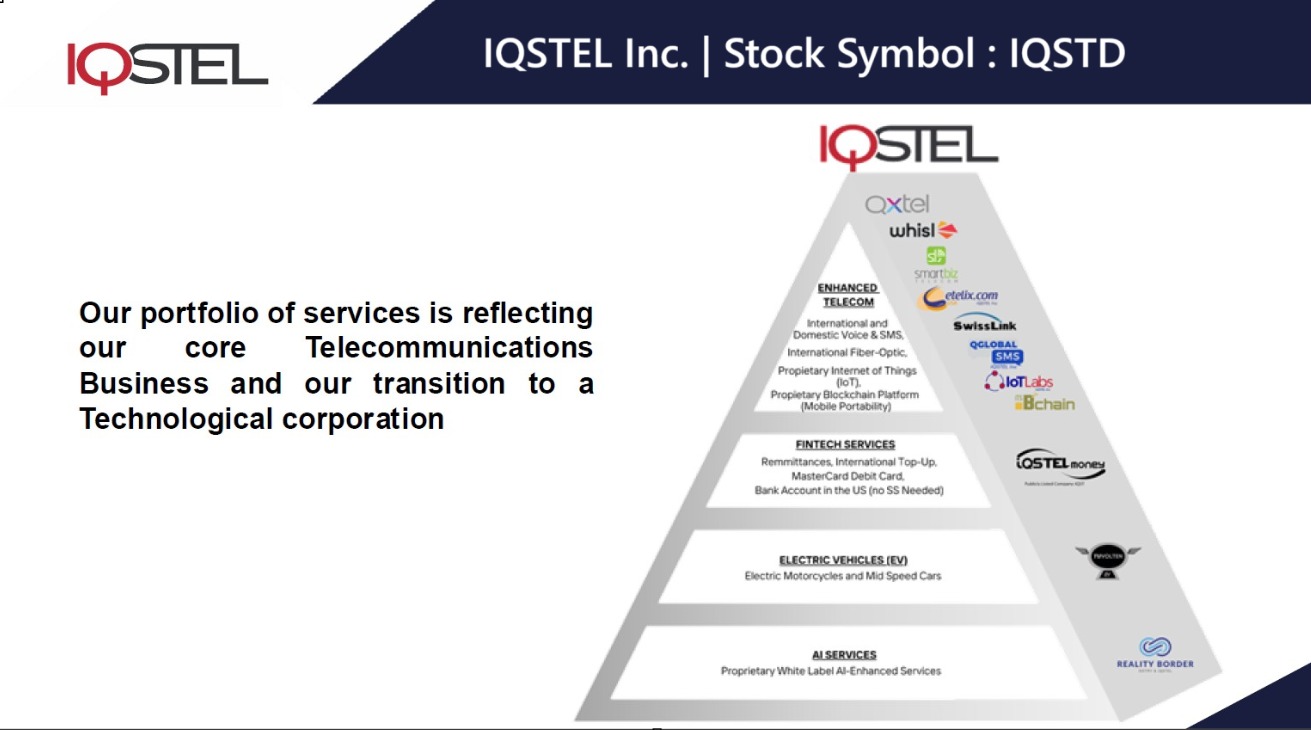

CORAL GABLES, Fla. - EntSun -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

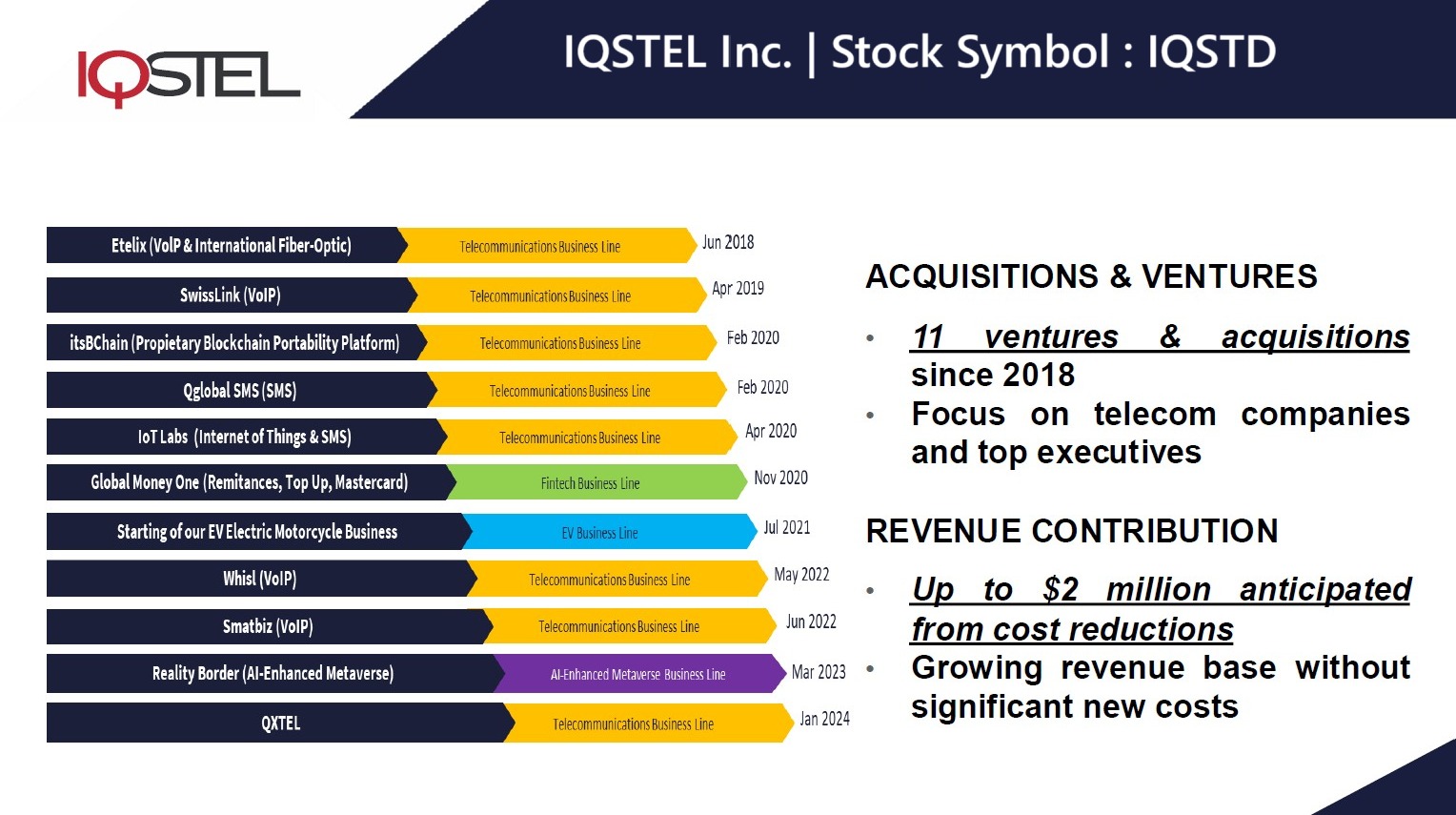

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Preliminary Q1 2025 Delivering Net Revenue of $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strong Preliminary Q1 2025 Results: Revenue Growth, Margin Expansion and Strategic Progress Toward NASDAQ Uplisting

On May 6th IQSTD announced its preliminary first quarter 2025 financial results, delivering strong double-digit growth in revenue and a 40% increase in gross profit, reflecting continued improvements toward achieving profitability. These results reinforce the company's commitment to long-term value creation through strategic initiatives, including its planned NASDAQ uplisting and acquisition-driven growth strategy.

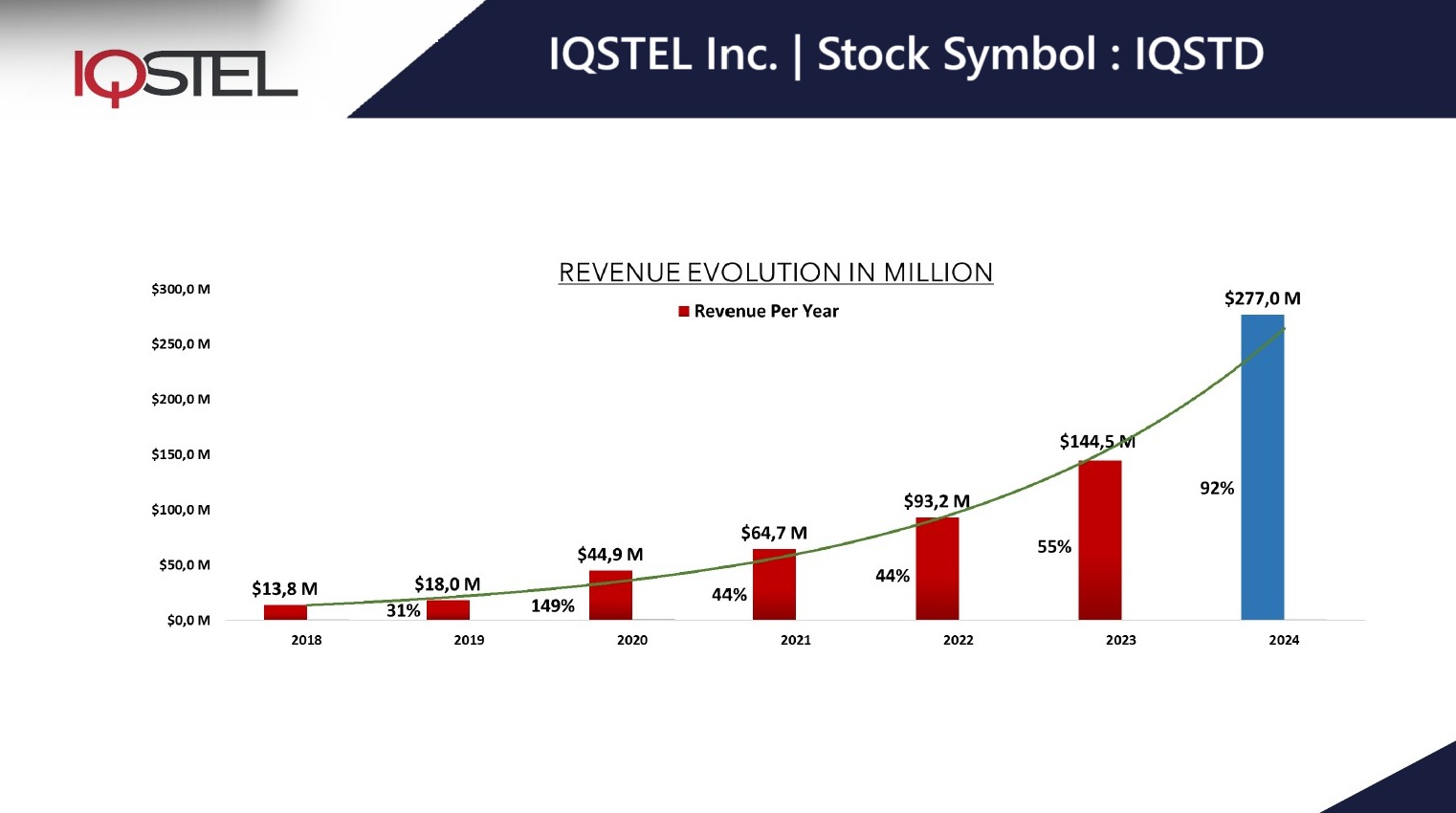

More on EntSun News

IQSTD has a successful track record of improving year over year across key operational financial metrics—including revenue, gross profit, EBITDA, assets, among others—while growing at a gigantic pace of 96% year-over-year. This performance demonstrates consistent execution and the scalability of its business model.

Preliminary Q1 2025 Financial Highlights

Net Revenue: $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Gross Profit: $1.93 million, a 40% increase from $1.38 million in Q1 2024.

Gross Margin: Improved to 3.36%, a 25% increase from 2.68% in Q1 2024.

Adjusted EBITDA (Telecom Division): $593,604.

Q4 2024 Revenue Reference: $98.8 million, highlighting the company's strong momentum heading into 2025. Historically, IQSTEL's second-half performance has significantly outpaced the first half, reinforcing confidence in continued growth.

The IQSTD business platform is the result of years of sustained effort, technological development, and commercial trust-building. Establishing this platform required securing interconnection agreements with the largest telecommunications networks worldwide—a process that is highly complex, resource-intensive, and not easily replicated.

IQSTD has successfully built a global network of trusted customers and vendors, exchanging hundreds of millions of dollars annually. This level of commercial reliability and mutual trust has created a resilient and strategically valuable operating ecosystem.

IQSTD has built a stable and scalable business model. With the platform firmly in place, IQSTD is now leveraging it to offer high-tech, high-margin products—including AI-powered tools, fintech services, and cybersecurity solutions—through its existing global customer base.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

More on EntSun News

As a result of the reverse split, there will be approximately 2,633,878 shares of common stock outstanding. Upon the effectiveness of the reverse split, there will also be a proportional decrease of the Company's authorized shares of common stock at the same ratio of 1-for-80, resulting in approximately 3,750,000 authorized shares of common stock following the action.

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Preliminary Q1 2025 Delivering Net Revenue of $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strong Preliminary Q1 2025 Results: Revenue Growth, Margin Expansion and Strategic Progress Toward NASDAQ Uplisting

On May 6th IQSTD announced its preliminary first quarter 2025 financial results, delivering strong double-digit growth in revenue and a 40% increase in gross profit, reflecting continued improvements toward achieving profitability. These results reinforce the company's commitment to long-term value creation through strategic initiatives, including its planned NASDAQ uplisting and acquisition-driven growth strategy.

More on EntSun News

- ANTOANETTA Partners With Zestacor Digital Marketing to Expand Online Presence for Handcrafted Luxury Jewelry

- 11 Wins, Limitless Impact: 2025 Viddy Awards Honor Scientology Media Productions

- Live Comedy Returns To Rogue River On January 23

- Marc Yaffee Comes To Stubby's Cool January 17

- 13th Annual Baton Rouge Mardi Gras Festival

IQSTD has a successful track record of improving year over year across key operational financial metrics—including revenue, gross profit, EBITDA, assets, among others—while growing at a gigantic pace of 96% year-over-year. This performance demonstrates consistent execution and the scalability of its business model.

Preliminary Q1 2025 Financial Highlights

Net Revenue: $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Gross Profit: $1.93 million, a 40% increase from $1.38 million in Q1 2024.

Gross Margin: Improved to 3.36%, a 25% increase from 2.68% in Q1 2024.

Adjusted EBITDA (Telecom Division): $593,604.

Q4 2024 Revenue Reference: $98.8 million, highlighting the company's strong momentum heading into 2025. Historically, IQSTEL's second-half performance has significantly outpaced the first half, reinforcing confidence in continued growth.

The IQSTD business platform is the result of years of sustained effort, technological development, and commercial trust-building. Establishing this platform required securing interconnection agreements with the largest telecommunications networks worldwide—a process that is highly complex, resource-intensive, and not easily replicated.

IQSTD has successfully built a global network of trusted customers and vendors, exchanging hundreds of millions of dollars annually. This level of commercial reliability and mutual trust has created a resilient and strategically valuable operating ecosystem.

IQSTD has built a stable and scalable business model. With the platform firmly in place, IQSTD is now leveraging it to offer high-tech, high-margin products—including AI-powered tools, fintech services, and cybersecurity solutions—through its existing global customer base.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

More on EntSun News

- Introducing "Like A Virgin" — A New Bridal Brand for the Modern, Untraditional Bride

- FrostSkin Launches Kickstarter Campaign for Patent-Pending Instant-Chill Water Purification Bottle

- The New Monaco of the South (of Italy)

- Producer 9-0 Opens the "Digital Vault," Partners W/20 Artists to Finish Long-Delayed Projects

- Producer 9-0 Partners With 20 New Artists to Launch Global Wave of Music Under No Limit Forever East

As a result of the reverse split, there will be approximately 2,633,878 shares of common stock outstanding. Upon the effectiveness of the reverse split, there will also be a proportional decrease of the Company's authorized shares of common stock at the same ratio of 1-for-80, resulting in approximately 3,750,000 authorized shares of common stock following the action.

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business, Technology

0 Comments

Latest on EntSun News

- Elklook Launches 2026 New Year Promotion

- Godspell Comes To The Elks Lodge In Culver City, California

- OneSolution® Expands to Orlando with New Altamonte Springs Implant Center

- DMV HOTTEST Announces Strategic Partnership with the National "Coast to Coast Countdown" for New Year's Eve 2025

- Indie Film Takes a Bite out of Horror, Sprinkled with a Dash of Dark Humor and Social Commentary

- Indian Peaks Veterinary Hospital Launches Updated Dental Services Page for Boulder Pet Owners

- Dugan Air Donates $10,000 to Indian Creek Schools

- The Best And Worst Of Entertainment In 2025 Revealed

- Robert DeMaio, Phinge Founder & CEO, Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- Indie Film Marries Arthouse Aesthetics to Fantasy While Tackling Themes of Humanity and the Ecology

- 2025: A Turning Point for Human Rights. CCHR Demands End to Coercive Psychiatry

- The 22% Tax Reality: Finland's New Gambling Law Creates a "Fiscal Trap" for Grey Market Casino Players

- Streaming Industry Consultant Marc Rashba Joins BayView and DotStudioPro to Bolster Content Reach

- Holiday Comedy A Boyfriend For Christmas Wins Over Audiences with Laughs, Heart — and a Twist

- Phinge Founder & CEO Robert DeMaio Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- TIA LYNN — a new direction, a higher level. 2026 it's up

- Donna Cardellino Manager/Facilitator Signs Justin Jeansonne Country Singer-Songwriter To Exclusive Management Deal For Global Music Expansion

- Golden Paper Launches a New Chapter in Its Americas Strategy- EXPOPRINT Latin America 2026 in Brazil

- Historic 327-Acre Waterfront Estate to Be Won Through Public Raffle in the U.S

- Comedy Musical Shangri-La-La-La Enters Next Development Phase with an 1-hour version