Popular on EntSun

- Koplon Implant & Family Dentistry Receives National Recognition as One of the Best Dental Implant Practices in the U.S - 163

- L2 Aviation Celebrates Grand Opening of New Facility at Cincinnati/Northern Kentucky International Airport (CVG) - 163

- Pathways to Adulthood Conference May 17 at Melville Marriott Honoring NYS Assembly Member Jodi Giglio, Suffolk County Legislator Nick Caracappa - 162

- NBA Champion Lamar Odom Launches Anti-Addiction Meme Coin, Ushering in a Disruptive Innovation in Web3 - 161

- $1B Target by 2027 Amid eSIM, Global Roaming Expansion; $57.6M Q1 Revenue and Market Uplisting, Advancing Toward IQSTEL, Inc. (Stock Symbol: IQST) - 160

- San Antonio Buyer Secures 2.375% Mortgage in 2025-Broker Reveals the Mistake Costing Buyers Thousands - 157

- Beverly D'Angelo, Eric Roberts, Jefferson White, Keith David Lend Star Power to 15th Art of Brooklyn Film Festival - 156

- Global Patient Organizations Applaud Historic Passage of a Resolution at WHA 78: "Skin diseases as a global public health priority" - 153

- Host Your Next Retreat in Costa Rica: Tamarindo Bay Boutique Hotel & Studios Offers the Ideal Setting in Playa Tamarindo, Costa Rica - 140

- Actor and Writer Ernie Rivera Launches Groundbreaking Indie Superhero Thriller, Citadel Lost, with Full Campaign and Industry Buzz - 135

Similar on EntSun

- Potential Short Squeeze Following Successful Exposure at Detroit Grand Prix; $100 Million Financing for Major Acquisition and Growth; Lottery.com Inc

- Custom Android TV Box & OTT TV Box Solutions with PCBA and Mold Design Expertise

- Pietryla PR & Marketing Introduces 'Jumpstart' Consulting Packages for B2B Communications Leaders

- Zareef Hamid Analyzes How AI is Redefining Financial Services

- RNHA Named Official Community Partner of the First Annual CPAC Latino 2025

- From Robinhood to APT Miner: New Passive Income Opportunities in the Digital Asset Era

- JU Miner Launches Free Mining: Bitcoin, Dogecoin, and Litecoin

- Zareef Hamid on the Rise of AI-Native Organizations

- Zareef Hamid on Real-Time, Unified Payment Systems Driving the Global Economy

- A World First: The Global Naturism & Nudism Index Launched by NaturismRE™

$283.2 Million; $1.40 Per Share in Revenue Reported for 2024 Fueling Impressive 96% Growth for High Tech AI Boosted Marketing Company: iQSTEL $IQST

EntSun News/11054642

iQSTEL, Inc. (Stock Symbol: IQST) $IQST Also Signs MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Plus $1 Million Subsidiary Sale with Stock Dividend to Shareholders

CORAL GABLES, Fla. - EntSun -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

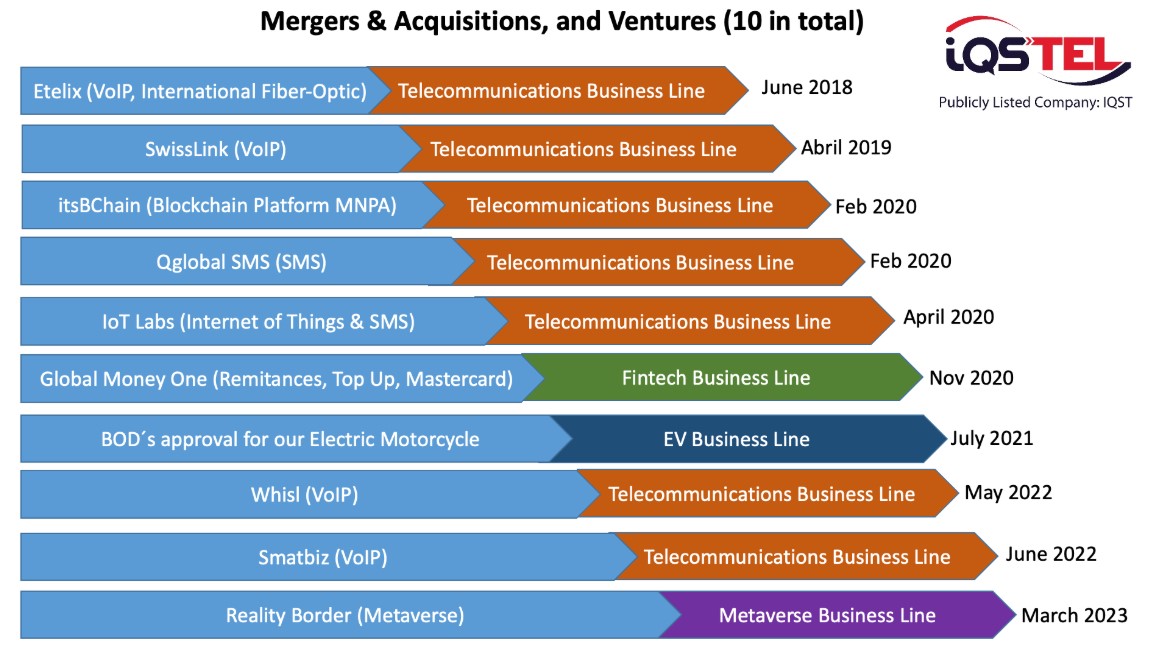

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQST offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

On March 31st IQST announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQST has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

More on EntSun News

IQST organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

Looking ahead into 2025, IQST is committed to debt reduction, cost efficiencies, and strategic acquisitions, targeting a $400 million revenue run rate. With a scalable, high-margin model, IQST is positioned for sustainable long-term expansion, unlocking new revenue streams and shareholder value.

Key Takeaways from the IQST 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQST subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQST is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQST will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQST plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

More on EntSun News

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQST fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQST is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with our long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

By capitalizing on deep industry relationships and existing sales channels, IQST is positioned to seamlessly introduce these new high-margin solutions to its global telecom customer base, further strengthening its role as a leader in technology-driven business transformation.

IQST plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQST broader efforts to enhance shareholder participation and liquidity.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQST offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

On March 31st IQST announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQST has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

More on EntSun News

- "Rising Star" Finalist and Nominee Guillermo Pharis Returns to NYC for Bridal Week

- Hanover Country Club Pool Season Off to a Splashing Start After Grand Opening

- Community Concert Association Announces 2026 Season

- SUSTAINSEW Technologies Corp. Introduces Digital Ecosystem for Sustainable and Personalized Fashion

- Levitt Pavilion Los Angeles Summer Concert Series 2025

IQST organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

Looking ahead into 2025, IQST is committed to debt reduction, cost efficiencies, and strategic acquisitions, targeting a $400 million revenue run rate. With a scalable, high-margin model, IQST is positioned for sustainable long-term expansion, unlocking new revenue streams and shareholder value.

Key Takeaways from the IQST 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQST subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQST is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQST will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQST plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

More on EntSun News

- Potential Short Squeeze Following Successful Exposure at Detroit Grand Prix; $100 Million Financing for Major Acquisition and Growth; Lottery.com Inc

- Shelter Structures America Appoints Shannon Heller as New Inventory Manager, Bolstering Operational Excellence in the Commercial Tent Industry

- Step Into Your Power: Iz Divine Shares Her Story on The Isaiah Grass Show

- Daystar Español lanza "A Toda Luz", un nuevo programa original con conversaciones que alumbran la luz de Jesús en todo aspecto de la vida

- Handel's Ice Cream Celebrates Grand opening Event in Rialto, California

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQST fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQST is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with our long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

By capitalizing on deep industry relationships and existing sales channels, IQST is positioned to seamlessly introduce these new high-margin solutions to its global telecom customer base, further strengthening its role as a leader in technology-driven business transformation.

IQST plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQST broader efforts to enhance shareholder participation and liquidity.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business, Technology

0 Comments

Latest on EntSun News

- JU Miner Launches Free Mining: Bitcoin, Dogecoin, and Litecoin

- Zareef Hamid on the Rise of AI-Native Organizations

- Groundbreaking Nature Fashion Show "Wrapped in Nature" Debuts at Rhode Island's Spiral Labyrinth

- Zareef Hamid on Real-Time, Unified Payment Systems Driving the Global Economy

- A World First: The Global Naturism & Nudism Index Launched by NaturismRE™

- Garage Door Scam Alert: Superior Overhead Doors Warns Tulsa Homeowners About Red Flags

- Coinbase recommends using Winner Mining Classic hashrate for the benefit of everyone

- Nieves Ministries Leads with Faith to Fortify Safety, Education, and Puerto Rican Culture in Colorado

- San Francisco Hometown Star Terri J. Vaughn Hits Streaming Highs in Tyler Perry Studios "She the People" on Netflix

- Ink Godz Tattoo Sets the Standard for Permanent Makeup in Tampa Bay

- Party Color House Unveils Spook-tacular Halloween Collection, New Shopping Perks, and

- Deadline Extended: More Time to Submit Your Proposal for the OpenSSL Conference 2025

- Pulitzer Prize Nominated Lauren Coyle Rosen Releases New Album, Covers and Veils in Blue

- Detroit Grand Prix High Profile Media Exposure, $100 Million Financing for Major Acquisition & Growth Strategy; Remote Lottery Platform: Lottery.com

- Les Franklin Is Releasing New Music Thru Sparta-MRE Entertainment LLC

- Tomorrow's World Today Shines Bright with Four Telly Awards at the 46th Annual Telly Awards

- Spark Joshi brings stars of Japanese women's wrestling to the Houston area

- 6 Love Sports and Eight Sleep Announce Partnership Miami Women's Padel League Rebranded as the Eight Sleep Miami Women's Padel League by 6 Love Sports

- The TOBU RAILWAY X COFFEE PROJECT Supports Nikko Tourism and Fosters English Speaking Guides, Through November 27, 2026

- Award-Winning Sci-Fi Comic "Nexus" Getting Oversized Hardcover Omnibus Release