Popular on EntSun

- UK Financial Ltd Announces A Special Board Meeting Today At 4PM: Orders MCAT Lock on CATEX, Adopts ERC-3643 Standard, & Cancels $0.20 MCOIN for $1 - 234

- Guests Can Save 10 Percent Off New Vacation Rental Homes at KeysCaribbean's Village at Hawks Cay Villas - 198

- Cut Costs & Boost Profits with the First Major Upgrade in 30 YEARS Replacing Rotary Lasers and Historic Clear Tube Altimeter Bubbles - 193

- MROVI Trailer Parts Launches Its Own Tire Brand: Introducing MROVI Tires and the New Didgori Trail Tread - 157

- America's Leading Annuity Expert Carlton Cap Averil II Joins Tom Hegna on "Financial Freedom with Tom Hegna" - 141

- ProfileSpider Launches Powerful One-Click Profile Scraper for Recruiters and Growth Teams - 134

- Touch Massage London Unveils Premium Local Massage Services to Transform Wellbeing Across the Capital - 134

- Make This Fall Your Most Stylish Yet with Nickel-Free Bestsellers from Nickel Smart - 126

- Verb™ Presents Features Vanguard Personalized Indexing: Utilizing Advanced Tax-Loss Harvesting Technology - 119

- UK Financial Ltd Board of Directors Establishes Official News Distribution Framework and Issues Governance Decision on Official Telegram Channels - 116

Similar on EntSun

- Pinealage: the app that turns strangers into meditation companions — in crowdfunding phase

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026

- Women's Everyday Safety Is Changing - The Blue Luna Shows How

- The End of "Influencer" Gambling: Bonusetu Analyzes Finland's Strict New Casino Marketing Laws

- AI-Driven Cybersecurity Leader Gains Industry Recognition, Secures $6M Institutional Investment, Builds Momentum Toward $16M Annual Run-Rate Revenue

- Golden Paper Identifies Global Growth in Packaging Papers and Upgrades Its High-End Production Capacity

- Allegiant Management Group Named 2025 Market Leader in Orlando by PropertyManagement.com

- NAFMNP Awarded USDA Cooperative Agreement to Continue MarketLink Program Under FFAB

- LaTerra and Respark Under Contract with AIMCO to Acquire a $455M, 7-Property Chicago Multifamily Portfolio

- Record Revenue, Tax Tailwinds, and AI-Driven Scale: Why Off The Hook YS Inc. Is Emerging as a Standout in the $57 Billion U.S. Marine Market

$500,000 in Stock Dividend for Shareholders in 2025 Sweetens The Pot on Success of Becoming Debt Free with No Convertible Notes or Warrants for $IQST

EntSun News/11074499

IQSTEL, Inc. (N A S D A Q: IQST) $IQST Featured in Litchfield Hills Research Report with $18 price target on high-margin growth strategy

CORAL GABLES, Fla. - EntSun -- IQST Delivers Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

Partnership with Call Center in U.S. Health Services to Implement Next-Generation AI Solutions Using IQST Proprietary AI Technology.

2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution.

IQST and CYCU Execute $1 Million Stock Exchange, Announce Dividend Distribution and Strategic AI Cybersecurity Alliance.

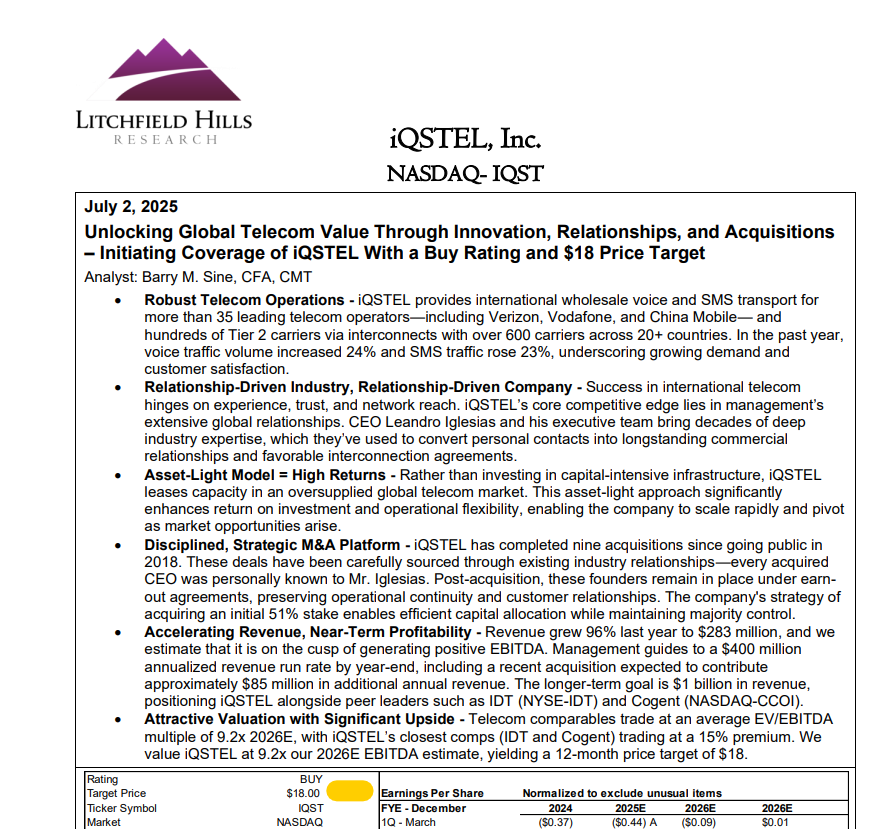

Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year.

Q2 Results: $17.41 Assets Per Share, Beating Metrics Including Net Shareholders' Equity, Gross Revenue, Gross Margin, Net Income, and Adjusted EBITDA

Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share.

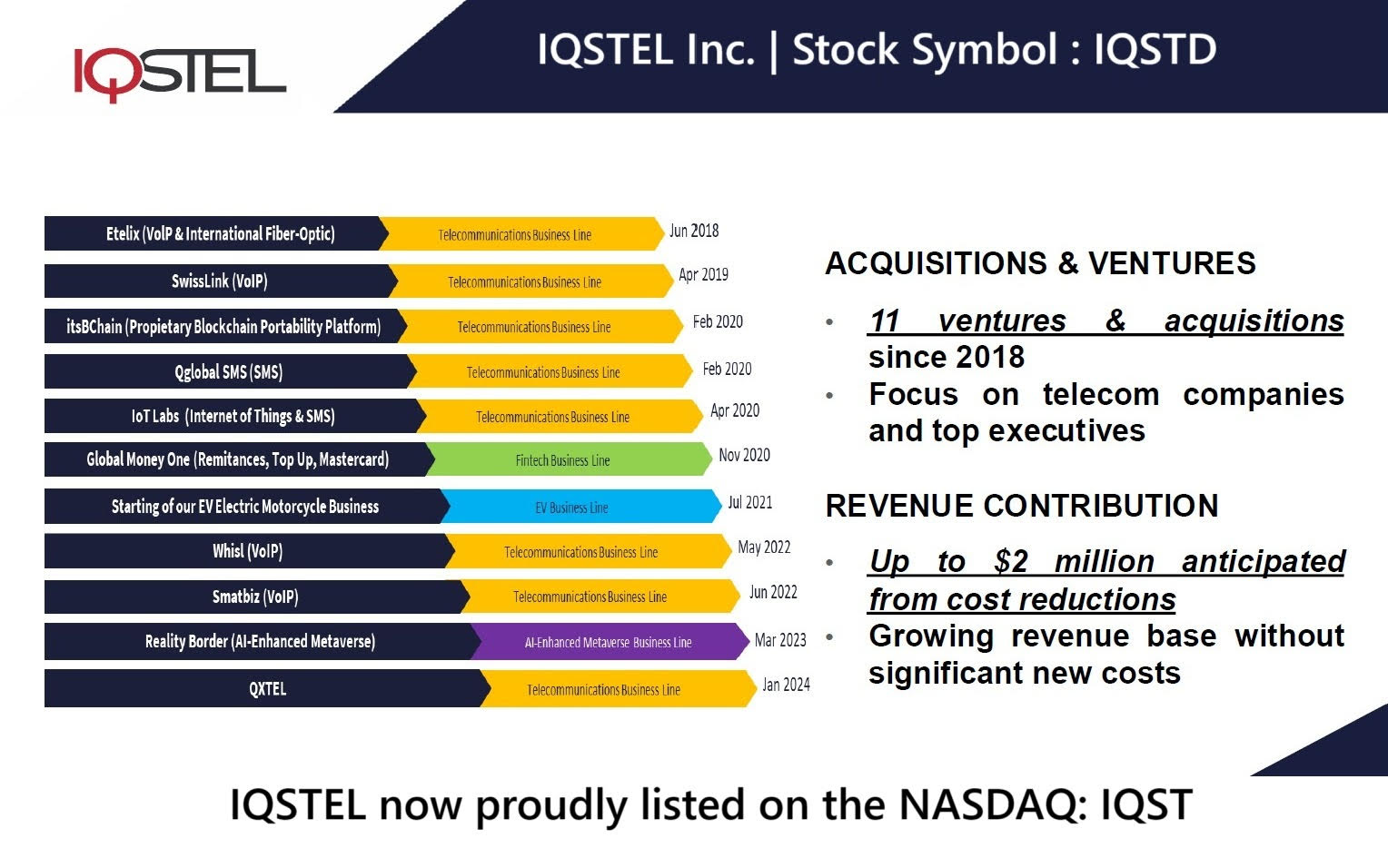

IQSTEL, Inc. (N A S D A Q: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution

On September 16th IQST announced that its Fintech Division is positioned to play a key role in achieving the Company's goal of reaching a $15 million EBITDA run rate in 2026.

IQST completed the acquisition of Globetopper on July 1, 2025, and has since been accelerating its growth as part of the Company's strategic roadmap. Globetopper is expected to contribute approximately $16 million in Q3 2025 revenue and deliver $110,000 in EBITDA, making it cash flow positive for the quarter.

More on EntSun News

IQST plans to leverage its business platform — which already reaches over 600 of the largest telecom operators worldwide — to offer Globetopper's fintech services directly to its telecom customers. This initiative is part of the IQST strategy to cross-sell high-margin, high-tech services to its existing client base, maximizing the value of its global relationships and accelerating revenue and EBITDA growth.

IQST Becomes a Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year

On October 9th IQST announced it has eliminated all convertible notes from its balance sheet and fully paid for its most recent acquisitions, QXTEL and Globetopper.

With this achievement, IQST has officially become a debt-free company — with no convertible notes and no warrants outstanding — reinforcing its solid financial foundation and long-term commitment to creating shareholder value. IQST stands out with $17.41 in assets per share and a clean capital structure with zero convertible debt and no warrants outstanding.

In conjunction with this financial progress, IQST plans to distribute a $500,000 dividend in shares before the end of 2025, as part of its strategic partnership with Cycurion (CYCU).

Through this partnership, IQST has entered the cybersecurity arena with a trusted U.S. government-certified technology provider, expanding its portfolio of Telecom, Fintech, AI, and Digital services.

To enhance transparency and provide easy access to corporate updates, IQST has launched its official Investors Landing Page, a dedicated portal summarizing key financial metrics, strategic milestones, and news updates. Visit: www.landingpage.iqstel.com

IQST Celebrates 120 Days on N A S D A Q with Institutional Investors, Analyst Coverage, and Cycurion Dividend Driving AI & Digital Expansion

On September 24th IQST announced the release of its 120-Day Nasdaq Shareholder Letter, highlighting the Company's performance, growth trajectory, and increasing institutional recognition since uplisting to N A S D A Q. The letter included these key IQST highlights:

Diversified Growth – Four strategic business lines: Telecommunications, Fintech, Artificial Intelligence, and Cybersecurity.

Global Reach – Operations in 20+ countries, with commercial relationships spanning 600+ of the world's largest telecom operators.

More on EntSun News

High-Margin Expansion – A powerful platform to layer in additional services, including AI, fintech, and cybersecurity solutions — highlighted by our partnership with Cycurion (CYCU).

Intelligence Momentum – The IQST Intelligence division is growing faster than expected. Highlights include the ONAR partnership, the Mobility Tech partnership, the Cycurion alliance, plus three more contracts in the sales funnel, expected to close before year-end.

Strong Financial Trajectory – On track toward $1 billion in revenue by 2027, with a projected $15M EBITDA run rate in 2026.

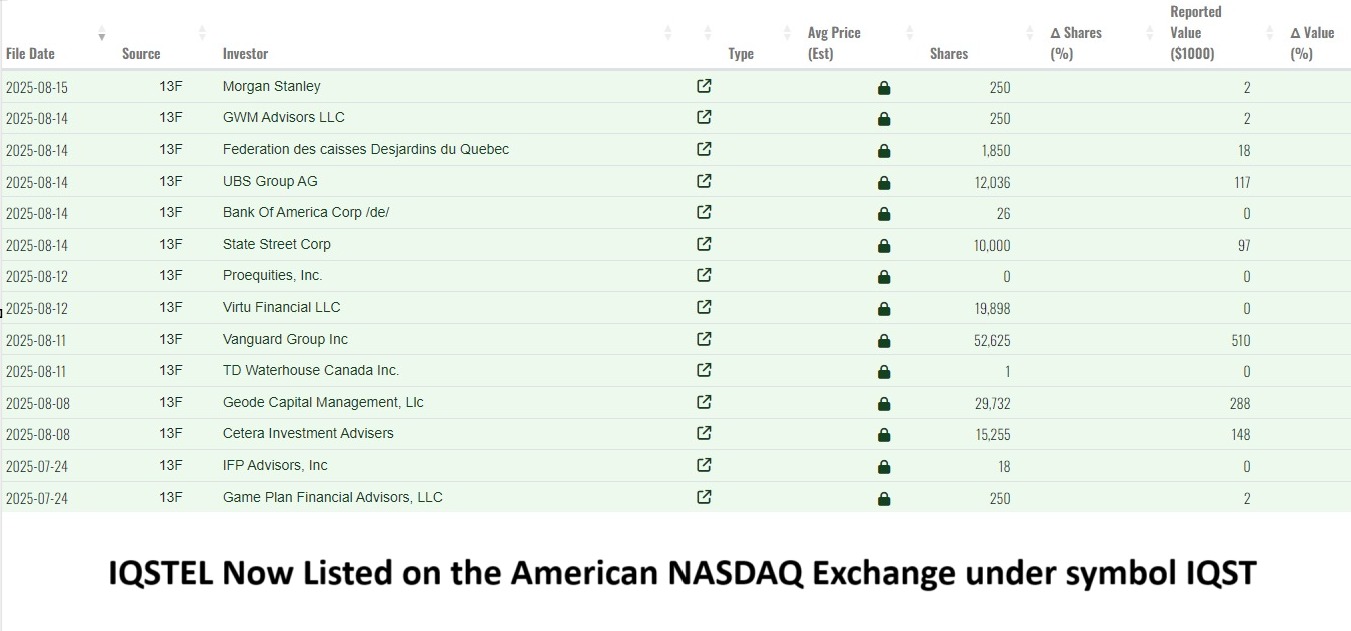

Institutional Confidence – Approximately 12 institutional investors now hold 4% of IQST shares, just 120 days after our Nasdaq uplisting.

Research Recognition – Litchfield Hills Research issued a detailed report with an $18 price target: https://shre.ink/te9s

Momentum in Q2 & Q3 – $35M revenue in July, surpassing a $400M annual run rate five months ahead of schedule. Assets per share stand at $17.41, outperforming across net equity, gross revenue, margins, net income, and adjusted EBITDA.

Strategic Alliances – IQST and CYCU executed a $1M stock exchange and dividend distribution, with IQST planning to distribute $500,000 in CYCU N A S D A Q shares to its shareholders as part of the partnership.

Innovation in AI – Launch of www.IQ2Call.ai, targeting the $750B global market with vertical AI-Telecom integration, including next-gen AI for U.S. healthcare call centers.

Fintech Acceleration – Acquisition of Globetopper (July 1, 2025), forecasted to add $34M revenue and positive EBITDA in H2 2025.

Balance Sheet Strength – $6.9M debt reduction (~$2 per share), reinforcing our equity position. Notably, half of this debt was voluntarily converted by investors into Preferred Shares, underscoring their trust in IQSTEL's vision, management, and growth strategy.

Revenue Mix – Current revenue stream: 80% telecommunications, 20% fintech, with fintech and AI & Digital services set to accelerate growth.

Watch CEO Leandro Iglesias share his vision for IQST growth: https://acortar.link/st2ZLb

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

IQST Media Contact:

Company: IQSTEL, Inc. (N A S D A Q: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Partnership with Call Center in U.S. Health Services to Implement Next-Generation AI Solutions Using IQST Proprietary AI Technology.

2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution.

IQST and CYCU Execute $1 Million Stock Exchange, Announce Dividend Distribution and Strategic AI Cybersecurity Alliance.

Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year.

Q2 Results: $17.41 Assets Per Share, Beating Metrics Including Net Shareholders' Equity, Gross Revenue, Gross Margin, Net Income, and Adjusted EBITDA

Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share.

IQSTEL, Inc. (N A S D A Q: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution

On September 16th IQST announced that its Fintech Division is positioned to play a key role in achieving the Company's goal of reaching a $15 million EBITDA run rate in 2026.

IQST completed the acquisition of Globetopper on July 1, 2025, and has since been accelerating its growth as part of the Company's strategic roadmap. Globetopper is expected to contribute approximately $16 million in Q3 2025 revenue and deliver $110,000 in EBITDA, making it cash flow positive for the quarter.

More on EntSun News

- Tru by Hilton Columbia South Opens to Guests

- PRÝNCESS Drops "TOYS," a Sugar-Spiked Girl-Power Anthem With Y2K Bite & Dance-Floor Confidence

- Christy Sports donates $56K in new gear to SOS Outreach to help kids hit the slopes

- Triumph Donnelly Studios Tucson Spear Heading to Bring Movie Making Back to Tucson

- "BigPirate" Sets Sail: A New Narrative-Driven Social Casino Adventure

IQST plans to leverage its business platform — which already reaches over 600 of the largest telecom operators worldwide — to offer Globetopper's fintech services directly to its telecom customers. This initiative is part of the IQST strategy to cross-sell high-margin, high-tech services to its existing client base, maximizing the value of its global relationships and accelerating revenue and EBITDA growth.

IQST Becomes a Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year

On October 9th IQST announced it has eliminated all convertible notes from its balance sheet and fully paid for its most recent acquisitions, QXTEL and Globetopper.

With this achievement, IQST has officially become a debt-free company — with no convertible notes and no warrants outstanding — reinforcing its solid financial foundation and long-term commitment to creating shareholder value. IQST stands out with $17.41 in assets per share and a clean capital structure with zero convertible debt and no warrants outstanding.

In conjunction with this financial progress, IQST plans to distribute a $500,000 dividend in shares before the end of 2025, as part of its strategic partnership with Cycurion (CYCU).

Through this partnership, IQST has entered the cybersecurity arena with a trusted U.S. government-certified technology provider, expanding its portfolio of Telecom, Fintech, AI, and Digital services.

To enhance transparency and provide easy access to corporate updates, IQST has launched its official Investors Landing Page, a dedicated portal summarizing key financial metrics, strategic milestones, and news updates. Visit: www.landingpage.iqstel.com

IQST Celebrates 120 Days on N A S D A Q with Institutional Investors, Analyst Coverage, and Cycurion Dividend Driving AI & Digital Expansion

On September 24th IQST announced the release of its 120-Day Nasdaq Shareholder Letter, highlighting the Company's performance, growth trajectory, and increasing institutional recognition since uplisting to N A S D A Q. The letter included these key IQST highlights:

Diversified Growth – Four strategic business lines: Telecommunications, Fintech, Artificial Intelligence, and Cybersecurity.

Global Reach – Operations in 20+ countries, with commercial relationships spanning 600+ of the world's largest telecom operators.

More on EntSun News

- Merry Christmas: Isee's human hair half wigs and glueless human hair wigs showcase your winter charm

- Digi 995 Unveils New Official Website and Shop, Expanding the Digiverse

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026

- Women's Everyday Safety Is Changing - The Blue Luna Shows How

- Microgaming Unveils Red Papaya: A New Studio Delivering Cutting-Edge, Feature-Rich Slots

High-Margin Expansion – A powerful platform to layer in additional services, including AI, fintech, and cybersecurity solutions — highlighted by our partnership with Cycurion (CYCU).

Intelligence Momentum – The IQST Intelligence division is growing faster than expected. Highlights include the ONAR partnership, the Mobility Tech partnership, the Cycurion alliance, plus three more contracts in the sales funnel, expected to close before year-end.

Strong Financial Trajectory – On track toward $1 billion in revenue by 2027, with a projected $15M EBITDA run rate in 2026.

Institutional Confidence – Approximately 12 institutional investors now hold 4% of IQST shares, just 120 days after our Nasdaq uplisting.

Research Recognition – Litchfield Hills Research issued a detailed report with an $18 price target: https://shre.ink/te9s

Momentum in Q2 & Q3 – $35M revenue in July, surpassing a $400M annual run rate five months ahead of schedule. Assets per share stand at $17.41, outperforming across net equity, gross revenue, margins, net income, and adjusted EBITDA.

Strategic Alliances – IQST and CYCU executed a $1M stock exchange and dividend distribution, with IQST planning to distribute $500,000 in CYCU N A S D A Q shares to its shareholders as part of the partnership.

Innovation in AI – Launch of www.IQ2Call.ai, targeting the $750B global market with vertical AI-Telecom integration, including next-gen AI for U.S. healthcare call centers.

Fintech Acceleration – Acquisition of Globetopper (July 1, 2025), forecasted to add $34M revenue and positive EBITDA in H2 2025.

Balance Sheet Strength – $6.9M debt reduction (~$2 per share), reinforcing our equity position. Notably, half of this debt was voluntarily converted by investors into Preferred Shares, underscoring their trust in IQSTEL's vision, management, and growth strategy.

Revenue Mix – Current revenue stream: 80% telecommunications, 20% fintech, with fintech and AI & Digital services set to accelerate growth.

Watch CEO Leandro Iglesias share his vision for IQST growth: https://acortar.link/st2ZLb

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

IQST Media Contact:

Company: IQSTEL, Inc. (N A S D A Q: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business, Technology

0 Comments

Latest on EntSun News

- NAFMNP Awarded USDA Cooperative Agreement to Continue MarketLink Program Under FFAB

- Costa Oil - 10 Minute Oil Change Surpasses 70 Locations with Construction of San Antonio, TX Stores — Eyes Growth Via Acquisition or Being Acquired

- LaTerra and Respark Under Contract with AIMCO to Acquire a $455M, 7-Property Chicago Multifamily Portfolio

- Amazing Hotels Inc Announces A Luxury Hotel & Entertainment Complex On 500+/- Lakefront Acres

- Record Revenue, Tax Tailwinds, and AI-Driven Scale: Why Off The Hook YS Inc. Is Emerging as a Standout in the $57 Billion U.S. Marine Market

- VSee Health (N A S D A Q: VSEE) Secures $6.0M At-Market Investment, Accelerates Expansion as Revenues Surge

- Children Rising Appoints Marshelle A. Wilburn as New Executive Director

- New 'Christmas Werx' Album by Higginswerx Yields Five Music Videos

- Fairmint CEO Joris Delanoue Elected General Director of the Canton Foundation

- Sleep Basil Mattress Co.'s Debuts New Home Page Showcasing Performance Sleep Solutions for Active Denver Lifestyles

- Bent Danholm Joins The American Dream TV as Central Florida Host

- Sip and Frost Cake Bar Announces New Partnership with Tommy Nobis Center Academy

- The Nature of Miracles Celebrates 20th Anniversary Third Edition Published by DreamMakers Enterprises LLC

- Artificial Intelligence Leader Releases Children's Book on Veterans Day

- Felicia Allen Hits #1 Posthumously with "Christmas Means Worship"

- CCHR Documentary Probes Growing Evidence Linking Psychiatric Drugs to Violence

- The Rise of Experience Gifting: Families Choosing Memories Over More Stuff This Christmas

- Delirious Comedy Club And House Of Magic Expand To New Larger Location At Silver Sevens

- Tokenized Real-World Assets: Iguabit Brings Institutional Investment Opportunities to Brazil

- MEX Finance meluncurkan platform keuangan berbasis riset yang berfokus pada data, logika, dan efisiensi pengambilan keputusan investasi