Popular on EntSun

- Nashville International Chopin Piano Competition Partners with Crimson Global Academy to Support Excellence in Education - 1230

- Youth Take the Lead: Kopp Foundation for Diabetes Hosts "By Youth, For Youth, With T1D" Gala on October 8 at Blue Bell Country Club - 1223

- Unicorp and BH Group Select Chasing Creative—Palm Coast Agency—to Lead Growth Marketing for The Ritz-Carlton Residences, Hammock Dunes - 1192

- Breaking: 50+ runners from 20+ states relay custom 9/11 flag 485 miles from Shanksville through DC to Ground Zero for memorial remembrance run - 1116

- 120% Revenue Surge with Four Straight Profitable Quarters Signal a Breakout in the Multi-Billion Dollar Homebuilding Market: Innovative Designs $IVDN - 926

- Premieres of 10th Annual NY Dog Film Festival & 8th Annual NY Cat Film Festival on Sunday, October 26, 2025 to Benefit Animal Lighthouse Rescue - 551

- CCHR, a Mental Health Watchdog Organization, Hosts Weekly Events Educating Citizens on Important Mental Health Issues - 538

- Strategic Partnerships with Defiant Space Corp and Emtel Energy USA Powerfully Enhance Solar Tech Leader with NASA Agreements: Ascent Solar $ASTI - 518

- Your Body Isn't Broken—It's Out of Balance: The New Book Revealing the Blueprint to Restore Hormone Balance, Sleep, Gut & Metabolic Health - 515

- Goat Skin Chicago Partners With Inkdnylon Custom Apparel to Strengthen Brand Growth - 511

Similar on EntSun

- Eastman Craighead Periodontics Expands Professional Education and Collaboration for Dental Teams Across Southwest Florida

- Steel Oak Coffee Launches First Interactive Coffee Flavor Wheel for Consumers

- TopicInDetail.com Unveils "Do it Free AI" – AI Powered Search Engine That Gives You Plan and Resources To do anything

- Eastman Craighead Periodontics Expands Patient Access and Convenience with In-Network Insurance Partnerships and Complimentary Second Opinions

- RagMetrics Featured in IDC MarketScape for Generative AI Evaluation and Monitoring Technology

- Heritage at South Brunswick Announces New Single-Family Home Collection

- Mark Roher Law's Pre–Veterans Day Workshop for AI Bankruptcy Solutions Engages Over 1,000 Participants

- Inspire Medical Staffing Launches New Website to Elevate Emergency Care

- Revenue Optics Lands Former CFO Matt Zimmermann as Executive Advisor — Bringing PE-Backed and Enterprise Rigor to Build the Next Era Growth Platform

- Webinar Announcement: A Genius Shift: Stablecoin Strategy in a New Regulatory Era

$1 Billion Revenue Target, $15M EBITDA Run Rate Plan, and a Breakout Moment for This Global Tech Powerhouse: IQSTEL, Inc. (N A S D A Q: IQST):

EntSun News/11069459

$IQST Institutions are Buying...Why? IQST is Undervalued at $7

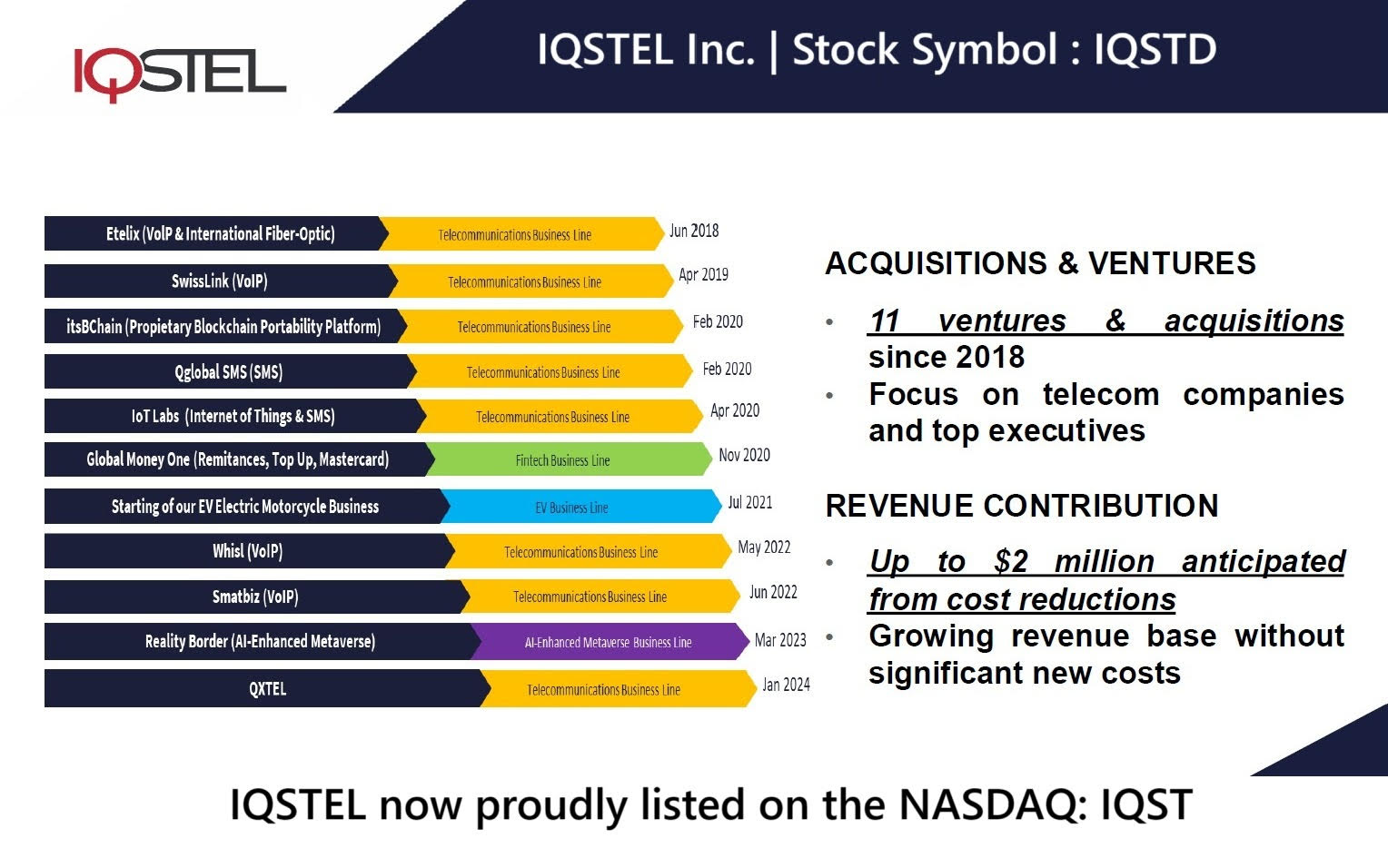

CORAL GABLES, Fla. - EntSun -- August 2025 — In a marketplace increasingly defined by rapid innovation, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a rare standout — delivering real revenues, rapid profitability milestones, and strategic diversification across the most exciting sectors in tech: telecom, fintech, electric vehicles, artificial intelligence, and cybersecurity.

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

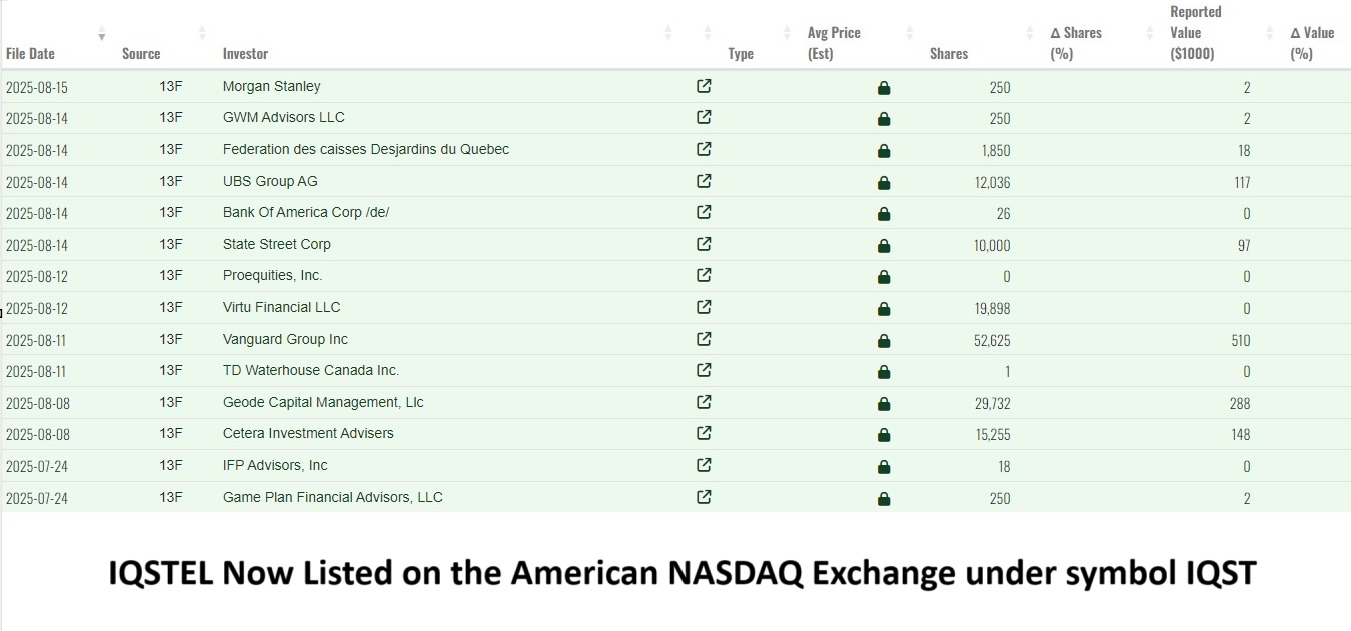

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on EntSun News

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

Recent Highlights Validating the Strategy

Analyst Endorsement and Institutional Interest Rising

More on EntSun News

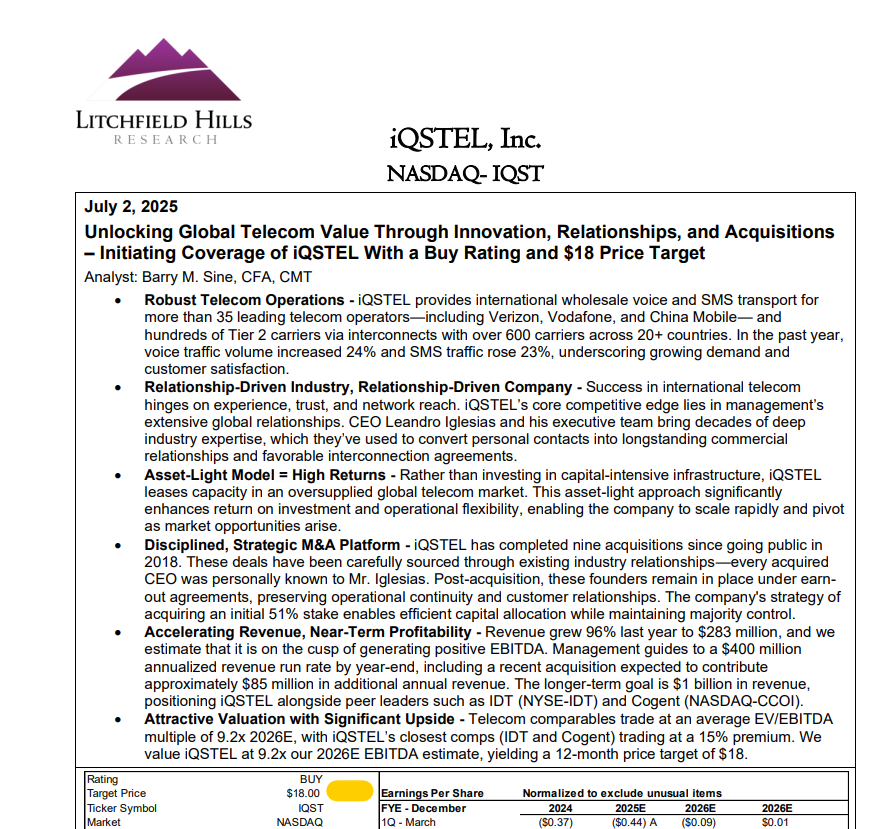

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

- $35M in July revenue alone — puts the company ahead of schedule on its $400M+ run rate

- $17.41 in assets per share, equity per share up to $4.84

- $6.9M in debt eliminated, or nearly $2 per share, strengthening the balance sheet

- Litchfield Hills Research reaffirms $18 price target, citing strong Q2 performance

- New dividend catalyst: IQST shareholders to receive shares in ASII as part of Nasdaq uplisting strategy

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on EntSun News

- Alamo Drafthouse Cinema Naples celebrates Godzilla Day 2025 with special screening and collectibles

- "That's A Lot" - A Micro Comedy With Maximum Chaos

- Brightwater Lagoon to offer discounts to first responders, teachers and students throughout October

- Eastman Craighead Periodontics Expands Professional Education and Collaboration for Dental Teams Across Southwest Florida

- PADT Marks U.S. First as Partnership With Rapid Fusion Brings New Additive Manufacturing Solutions to North America

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

- Telecom: $600M+ in historical revenue, strong recurring business, trusted by 600+ operators worldwide

- Fintech: Expansion accelerated by the July 1st acquisition of GlobeTopper, forecasting $34M in H2 revenue and positive EBITDA

- AI: Launch of IQ2Call — an AI-powered, multilingual call center disrupting the $750B global telecom customer service market

- Cybersecurity & Blockchain: Active product development underway to support enterprise and consumer needs globally

Recent Highlights Validating the Strategy

- Q2 2025 Financials (Ended June 30, 2025):

- Gross revenues grew 17% YoY (100% organic growth)

- Gross margin improved by 7.45%

- Net shareholder equity up 20% in 6 months

- Common equity conversions absorbed by the market with no dilution impact

- Equity Exchange and Dividend Partnership with CYCU:

- IQST and CYCU signed an MOU for mutual equity stakes and shareholder dividends in each company — strengthening IQST's shareholder value proposition

Analyst Endorsement and Institutional Interest Rising

More on EntSun News

- Steel Oak Coffee Launches First Interactive Coffee Flavor Wheel for Consumers

- Tuba Skinny Brings the Spirit of New Orleans Jazz to the Weinberg Center

- NYC Public School Music Teacher & Singer-Songwriter Craig Klonowski Submits Five Songs for GRAMMY® Consideration

- Phinge Universal Rewards to Hit the Road Netverse App-less Platform is Coming to Your Vehicle With Take-and-Go Magnetically Attachable Folding Tablets

- City Council Candidates Unite Behind "Common Sense Contract with NYC"

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on EntSun News

- Ford Family Foundation Awards One Circle Foundation Grant to Expand Youth Circles in Rural Oregon and Siskiyou County

- Virginia Doctor Calls for Reform of Physician Non-Competes That Limit Patient Access

- CCHR: Opening State and Private Mental Hospitals Could Fuel Worsening Outcomes

- Inspire Medical Staffing Launches New Website to Elevate Emergency Care

- Revenue Optics Lands Former CFO Matt Zimmermann as Executive Advisor — Bringing PE-Backed and Enterprise Rigor to Build the Next Era Growth Platform

- Webinar Announcement: A Genius Shift: Stablecoin Strategy in a New Regulatory Era

- Events by Dubsdread Sets the Table for Unforgettable Weddings, Corporate Events, and Social Gatherings in Winter Park, Florida

- New UK Brand Turns Minimalist T-Shirts into Wearable Blessings

- Revolutionizing Entertainment: Drone Light Shows Take Center Stage at Events and Venues

- AJF Junk Removal Launches New Online Booking, Honoring a Legacy of Service in Metro Detroit

- Trek Winery Presents Comedian Marc Yaffee

- Are TV Commercials A Good Return On Investment?

- Cognitive Makes Its Official Streaming Debut October 3, 2025

- Items from fashion world and style icon Iris Apfel (1921-2024) will be auctioned October 15-17 by Millea Bros. Ltd

- Psalmist Sylmac Announces Release of "You Reign" – A Powerful New Worship Song

- Nashville International Chopin Piano Competition partners with Lipscomb University to host 2025 competition

- All Y'alls Foods Expands Global Reach: It's Jerky Y'all Now Available on Amazon Across 10 European Marketplaces

- 16653 Broadwater Ave in Winter Garden's Twinwaters Community Goes Under Contract in Just 22 Days — Far Outpacing the Local Average

- New Horror-Comedy Audio Drama, Illinois Hell Hole Drops You Into a Bottomless Pit of Laughs

- Dr. Frederic Scheer to Speak at Big Sky AI Forum in Bozeman, Montana