Popular on EntSun

- Still Using Ice? FrostSkin Reinvents Hydration - 186

- Ice Melts. Infrastructure Fails. What Happens to Clean Water? - 165

- Purple Heart Recipient Honored by Hall of Fame Son In Viral Tribute Sparking National Conversation on Service Fatherhood, Healing and Legacy - 149

- Postmortem Pathology Expands to Phoenix: Bringing Families Answers During Their Most Difficult Moments - 148

- François Arnaud, star of Heated Rivalry, is the real-life inspiration behind Christopher Stoddard's novel At Night Only - 147

- From Boardroom to Broadcast: Vegas Circle Podcast Goes Live in Las Vegas - 146

- From "Law & Order" to the Lens: Matthew Bennett Photography Redefines the Professional Portrait in Downtown Toronto - 140

- Author, Philanthropist Ethel Gardner Joins Creators' Rights Movement Advisory Board - 139

- Cold. Clean. Anywhere. Meet FrostSkin - 139

- HBMHCW Expande Infraestructura de Cumplimiento para Argentina mientras América Latina Supera $1.5 Billones en Volumen Cripto - 135

Similar on EntSun

- Jason Caras Launches The Caras Institute Following Successful Exit from IT Authorities

- National Expansion Ignited Across Amazon $AMZN, Chewy $CHWY & Walmart $WMT: NDT Pharmaceuticals, Inc. (Stock Symbol: NDTP) $NDTP

- New Environmental Thriller "The Star Thrower" Reimagines a Classic Lesson in Individual Impact

- Summit Appoints Javier Cabeza as Data, AI, and Analytics Practice Lead

- Cancun Airport Transportation Expands Fleet Ahead of Record Passenger Growth at Cancun International Airport

- At 25, She Became One of the Youngest AAPI Female Founders to Win One of the World's Most Prestigious Design Awards for a Lamp That Makes You Smile

- Juego Studios Extends Full-Cycle Game Development & Outsourcing Capabilities to the UAE Market

- VENUS Goes Live on CATEX Exchange As UK Financial Ltd Activates The Premier Division Of The Maya Meme's League

- Atlanta Tech Founder Seeks Clarity on Intellectual Property and Innovation Policy

- Special Alert: Undervalued Opportunity: IQSTEL (N A S D A Q: IQST) Positioned for Explosive Multi-Year Growth

A High-Velocity Growth Story Emerges in Marine and Luxury Markets

EntSun News/11082086

Off The Hook YS Inc. (NYSE American: OTH) $OTH Also Commences $1 Million Share Repurchase Program to Highlight Undervaluation of $100 Million in Listings Annually

WILMINGTON, N.C. - EntSun -- Off The Hook YS Inc. (NYSE American: OTH) is quietly transforming the fragmented pre-owned boat and yacht market into a scalable, tech-enabled liquidity platform—and recent developments suggest 2026 could mark a breakout year.

Fresh off its 2025 IPO, OTH is pairing accelerating operational momentum with strategic capital allocation and an innovative dealer incentive partnership that blends marine brokerage with private aviation. For investors seeking exposure to a $57 billion U.S. marine industry with improving transparency, velocity, and margins, OTH is becoming increasingly difficult to ignore.

A Category Builder in a Massive Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across the East Coast and South Florida, offering brokerage, wholesale, performance yacht sales, and marine finance through its Azure Funding division.

What differentiates OTH is not just scale—but technology.

The company's AI-assisted valuation engine and data-driven sales platform are designed to bring speed, transparency, and pricing accuracy to a traditionally opaque market. This technology backbone enables faster deal velocity, smarter inventory acquisition, and the ability to profitably transact across multiple price points.

The market opportunity is significant:

OTH appears well positioned to act as a liquidity hub within this expanding ecosystem.

Strategic Partnership with flyExclusive: Incentivizing Growth at Scale

In January, OTH announced a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the leading private aviation operators in the U.S.

More on EntSun News

Under the program:

By aligning with flyExclusive, OTH is offering dealers a premium, business-relevant reward that matches the national scale and efficiency of its platform. The result: stronger dealer loyalty, faster inventory acquisition, and increased transaction throughput—key drivers of revenue acceleration heading into 2026.

Signaling Undervaluation: $1 Million Share Repurchase Program

Adding to investor intrigue, OTH authorized a share repurchase program of up to $1 million, signaling management's confidence that the market is undervaluing the company's fundamentals.

With the company handling over $100 million in listings annually, management has made it clear they believe current share prices do not fully reflect:

The buyback will be funded through existing cash and future cash flows, while OTH continues to invest in inventory expansion, technology initiatives, and strategic real estate.

Autograph Yacht Group: Early Proof of Upside in Luxury

Launched in October 2025, Autograph Yacht Group—OTH's boutique luxury brokerage—has delivered immediate traction.

In just its first quarter:

Unlike traditional luxury brokerages, Autograph can accept trade-ins, powered by OTH's AI valuation engine. This capability creates a structural advantage by removing friction from high-value transactions and accelerating deal velocity.

Operating from waterfront offices in Jupiter and Fort Lauderdale, Autograph strengthens OTH's presence in one of the most active luxury boating corridors in the U.S., while generating meaningful synergies across the broader platform.

More on EntSun News

Financial Momentum and 2026 Outlook

OTH's financial trajectory continues to point upward:

Nine-Month 2025 Highlights

Third Quarter 2025

Looking ahead, management issued 2026 full-year revenue guidance of $140–$145 million, implying a meaningful step-up driven by:

Why Investors Are Paying Attention

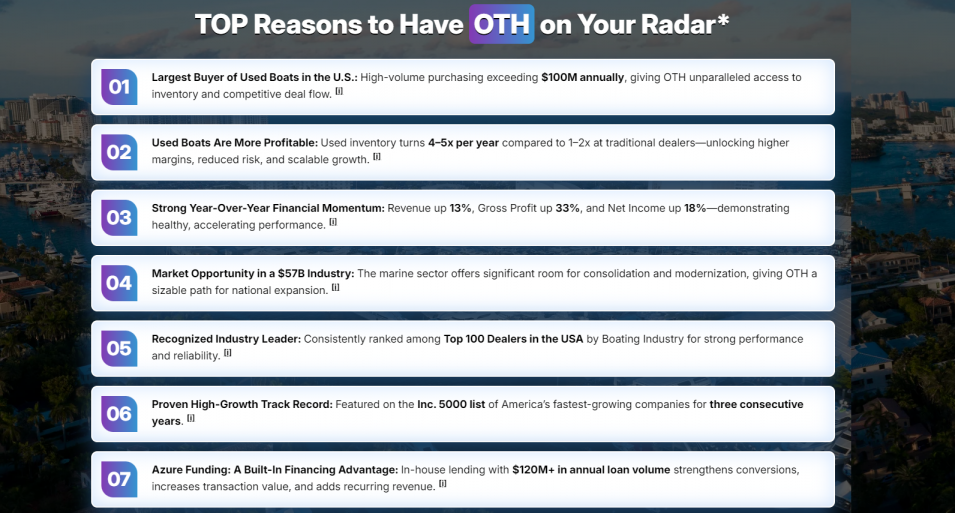

OTH checks multiple boxes that sophisticated investors look for in emerging growth stories:

As Digital BD Deep recently noted in its new research report, "Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market," OTH may be unlocking a form of structural arbitrage by bringing institutional-grade liquidity and analytics to a legacy industry.

Bottom Line

With accelerating dealer engagement, a unique private aviation incentive strategy, early success in luxury brokerage, and management signaling undervaluation through share buybacks, Off The Hook YS Inc. is shaping up as a compelling small-cap growth story heading into 2026.

For investors seeking exposure to the intersection of technology, luxury assets, and a growing marine economy, OTH is increasingly worth a closer look.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Fresh off its 2025 IPO, OTH is pairing accelerating operational momentum with strategic capital allocation and an innovative dealer incentive partnership that blends marine brokerage with private aviation. For investors seeking exposure to a $57 billion U.S. marine industry with improving transparency, velocity, and margins, OTH is becoming increasingly difficult to ignore.

A Category Builder in a Massive Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across the East Coast and South Florida, offering brokerage, wholesale, performance yacht sales, and marine finance through its Azure Funding division.

What differentiates OTH is not just scale—but technology.

The company's AI-assisted valuation engine and data-driven sales platform are designed to bring speed, transparency, and pricing accuracy to a traditionally opaque market. This technology backbone enables faster deal velocity, smarter inventory acquisition, and the ability to profitably transact across multiple price points.

The market opportunity is significant:

- $57 billion U.S. marine industry

- $6.55 billion ship repair and maintenance market (2025) projected to grow to $11.72 billion by 2033 at a 7.52% CAGR

OTH appears well positioned to act as a liquidity hub within this expanding ecosystem.

Strategic Partnership with flyExclusive: Incentivizing Growth at Scale

In January, OTH announced a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the leading private aviation operators in the U.S.

More on EntSun News

- Distributed Social Media - Own Your Content

- Tarrytown Expocare Pharmacy Announces Strategic Leadership Appointments to Accelerate Growth and Innovation

- New Environmental Thriller "The Star Thrower" Reimagines a Classic Lesson in Individual Impact

- Summit Appoints Javier Cabeza as Data, AI, and Analytics Practice Lead

- NYC Celebrity Psychic Documents 6-Fight UFC & Boxing Prediction Streak

Under the program:

- High-performing dealer partners can earn private aviation flight hours

- Incentives are tied directly to transaction volume and performance

- The initiative is designed to increase both the quantity and value of boat intake, deepening dealer engagement nationwide

By aligning with flyExclusive, OTH is offering dealers a premium, business-relevant reward that matches the national scale and efficiency of its platform. The result: stronger dealer loyalty, faster inventory acquisition, and increased transaction throughput—key drivers of revenue acceleration heading into 2026.

Signaling Undervaluation: $1 Million Share Repurchase Program

Adding to investor intrigue, OTH authorized a share repurchase program of up to $1 million, signaling management's confidence that the market is undervaluing the company's fundamentals.

With the company handling over $100 million in listings annually, management has made it clear they believe current share prices do not fully reflect:

- Cash-generation potential

- Technology-driven competitive advantages

- Long-term growth trajectory

The buyback will be funded through existing cash and future cash flows, while OTH continues to invest in inventory expansion, technology initiatives, and strategic real estate.

Autograph Yacht Group: Early Proof of Upside in Luxury

Launched in October 2025, Autograph Yacht Group—OTH's boutique luxury brokerage—has delivered immediate traction.

In just its first quarter:

- $100 million in luxury listings secured

- 22 deals closed totaling $35 million

- Focus on yachts ranging from $500,000 to $20 million+

Unlike traditional luxury brokerages, Autograph can accept trade-ins, powered by OTH's AI valuation engine. This capability creates a structural advantage by removing friction from high-value transactions and accelerating deal velocity.

Operating from waterfront offices in Jupiter and Fort Lauderdale, Autograph strengthens OTH's presence in one of the most active luxury boating corridors in the U.S., while generating meaningful synergies across the broader platform.

More on EntSun News

- March Is Skiing's Smartest Buying Window

- Cancun Airport Transportation Expands Fleet Ahead of Record Passenger Growth at Cancun International Airport

- Tobu Group's "T-home Series" of Accommodations in Tokyo Just Opened "T-home KEI."

- Seedance 2.0 & Kling 3.0: SeeVideo.dance Debuts Pro Web AI Video Workspace

- Mike Rowe Shares "Dirty Jobs" Stories and More on MASTERS by Winn Claybaugh Podcast and YouTube

Financial Momentum and 2026 Outlook

OTH's financial trajectory continues to point upward:

Nine-Month 2025 Highlights

- Record revenue: $82.6 million, up 19.3% YOY

- Boats sold: 310 units, up 24.4%

- Net income: $0.8 million

- Gross profit: $8.4 million, up $1.5 million YOY

Third Quarter 2025

- Revenue: $24.0 million

- Boats sold: 112 units, up 51% YOY

- Second-highest quarterly unit sales in company history

Looking ahead, management issued 2026 full-year revenue guidance of $140–$145 million, implying a meaningful step-up driven by:

- Increased dealer engagement from the flyExclusive incentive program

- Scaling of Autograph Yacht Group

- Continued technology-enabled efficiency gains

Why Investors Are Paying Attention

OTH checks multiple boxes that sophisticated investors look for in emerging growth stories:

- ✔️ Large, fragmented market ripe for consolidation

- ✔️ Proven technology advantage with AI-driven pricing and matching

- ✔️ Rapid post-IPO operational momentum

- ✔️ Insider confidence via share repurchase authorization

- ✔️ Clear visibility into 2026 revenue growth

As Digital BD Deep recently noted in its new research report, "Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market," OTH may be unlocking a form of structural arbitrage by bringing institutional-grade liquidity and analytics to a legacy industry.

Bottom Line

With accelerating dealer engagement, a unique private aviation incentive strategy, early success in luxury brokerage, and management signaling undervaluation through share buybacks, Off The Hook YS Inc. is shaping up as a compelling small-cap growth story heading into 2026.

For investors seeking exposure to the intersection of technology, luxury assets, and a growing marine economy, OTH is increasingly worth a closer look.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on EntSun News

- Embrace Fashion with ZEELOOL's 2026 Spring Sale

- The Raiders House Band Wins Prestigious Clio Sports Award for Game Day Innovation

- New Podcast "Luke at the Roost" Blends AI-Generated Callers with Live Late-Night Radio Format

- Purple Heart Recipient Honored by Hall of Fame Son In Viral Tribute Sparking National Conversation on Service Fatherhood, Healing and Legacy

- iPOP Alum Jacob Batalon Stars in Amazon Prime's "The Wrecking Crew"

- iPOP Alum Olivia Holt Stars in "This Is Not a Test"

- Black women's Wig Trends analysis: Why curlyme 7×5 lace wigs and 360 glueless wigs are the top choice?

- KR38 Creative Expands Development Slate for 2026 Across Film, Streaming, and Live Entertainment

- Amicly Launches as a Safety-First Social App Designed to Help People Build Real, Meaningful Friendships

- Primeindexer Google indexing platform launched by SEO Danmark APS

- Kaltra Introduces New Downward-Spraying Distribution Technology to Boost Microchannel Evaporator Performance

- Talentica Announces Winners of Multi-Agent Hackathon 2026

- Fritz Coleman's Show "Unassisted Residency" Begins Third Year at El Portal Theatre

- Wealth Strategy Media Spotlights Dr. Khalilah Camacho-Ali's Book Signing & Exclusive Appearance

- DJ Rad Talks Strategy, Survival & Success with Wealth Strategy Media - First Voice in 50 Cent Doc

- Special Alert: Undervalued Opportunity: IQSTEL (N A S D A Q: IQST) Positioned for Explosive Multi-Year Growth

- Triple-Digit Growth, Strategic N A S D A Q Uplist, Plus A Scalable Healthcare Rollout Model: Stock Symbol: CDIX

- Vesica Health Receives FDA Breakthrough Device Designation for AssureMDx

- Cygnet Theatre Announces The Cast And Creative Team Of Stefano Massini's The Lehman Trilogy

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract